TORONTO, Feb. 24, 2025 (GLOBE NEWSWIRE) — OMERS, the defined benefit pension plan for Ontario’s broader municipal sector employees, achieved a 2024 investment return of 8.3%, or $10.6 billion, net of expenses, exceeding its 7.5% benchmark for the year. Net assets at December 31, 2024, grew to $138.2 billion from $128.6 billion in 2023. The Plan reported a smoothed funded status of 98%, up from 97% in 2023. Over the past 10 years, OMERS has averaged an annual investment return of 7.1%, net of expenses, adding $70.5 billion to the Plan.

“Our strong result in 2024 reflects the quality of our people and portfolio, our active strategic decisions, and our steady progress as a long-term investor. Since becoming CEO of OMERS, I have been incredibly proud of the work of our leaders and their teams, as well as the forward-thinking strategies we have implemented over the last four years as we emerged from the pandemic. This combination has generated an average annual net return of 8.1% during that period,” said Blake Hutcheson, OMERS President and Chief Executive Officer. “As we look to the future, we are steadfast in our view that quality will see us through an unpredictable global landscape and the cycles ahead. Our talented team is focused on delivering our pension promise and is honoured to work in service of our almost 640,000 members.”

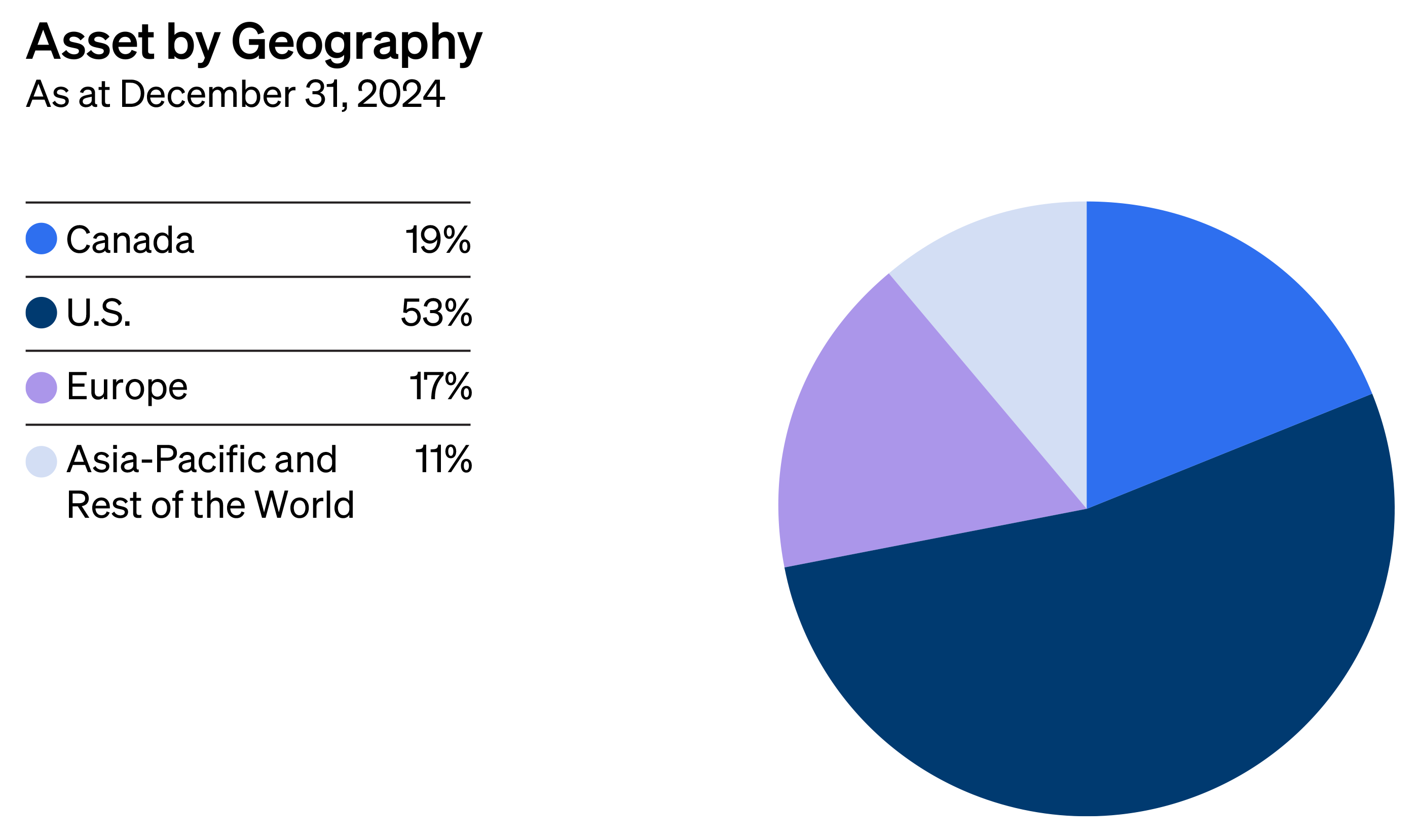

“Our actions to diversify the global portfolio positioned the Plan well in 2024,” said Jonathan Simmons, OMERS Chief Financial and Strategy Officer. “OMERS public equity investments delivered double-digit performance supported by strong contributions from private credit and infrastructure. Our net investment results benefitted from our active strategy to maintain currency exposure to the US dollar. Our real estate assets continue to generate strong operating income, but returns were held back due to lower valuations. Our asset mix continued to shift toward a higher exposure to fixed income, where return opportunities remain attractive. We expanded our overall use of leverage as we continued to use debt prudently to enhance our investment returns.”

This year, we are reporting that OMERS achieved a 58% reduction in its portfolio carbon emissions intensity, relative to 2019, and we reported an increase in green investments to $23 billion. For more information on how we define green investments, please refer to the OMERS Climate Taxonomy.

OMERS is highly rated across independent credit rating agencies, including ‘AAA’ ratings from S&P, Fitch, and DBRS.

OMERS will publish its 2024 Annual Report on February 28, 2025.

Media Contact:

Don Peat

[email protected]

416.417.7385

About OMERS

OMERS is a jointly sponsored, defined benefit pension plan, with 1,000 participating employers ranging from large cities to local agencies, and almost 640,000 active, deferred and retired members. Our members include union and non-union employees of municipalities, school boards, local boards, transit systems, electrical utilities, emergency services and children’s aid societies across Ontario. OMERS teams work in Toronto, London, New York, Amsterdam, Luxembourg, Singapore, Sydney and other major cities across North America and Europe – serving members and employers, and originating and managing a diversified portfolio of high-quality investments in government bonds, public and private credit, public and private equities, infrastructure and real estate.

Net Investment Returns for the years ended December 31

| 2024 | 2023 | ||

| Government Bonds | 1.0% | 5.8% | |

| Public Credit | 6.0% | 6.2% | |

| Private Credit | 12.6% | 10.0% | |

| Public Equities | 18.8% | 10.4% | |

| Private Equities | 9.5% | 3.9% | |

| Infrastructure | 8.8% | 5.5% | |

| Real Estate | -4.9% | -7.2% | |

| Total Net Return | 8.3% | 4.6% |

2024 Asset Mix

2024 Highlights

By the numbers

- 2024 investment return of 8.3%, or $10.6 billion, net of expenses

- $138.2 billion in net assets

- 10-year average annual net return of 7.1%

- 639,546 OMERS members

- 98% smoothed funded ratio

- 3.70% real discount rate, 5 basis points lower than 2023

- $6.5 billion total pension benefits paid

- We are reporting a 58% reduction in the portfolio carbon emissions intensity, relative to 2019

- $23 billion in green investments

- 96% OMERS member service satisfaction

- 93% of employees are proud to work for OMERS and Oxford (+5 points above best-in-class)

Transactions in 2024

OMERS remains focused on deploying capital in line with our target asset mix. We are a disciplined investor in high-quality assets that meet the Plan’s risk and return requirements. Please find below highlights of investments made in 2024.

- Acquired Italy’s Grandi Stazioni Retail which manages the entirety of commercial and advertising spaces in 14 of Italy’s major railway stations and hubs for the high-speed rail network, which collectively receive over 800 million visits a year. The stations include over 800 commercial units, totaling around 190,000 Sqm of leasable space, and over 1,800 media assets.

- Increased our stake by 13.5% in Indian roads business Interise Trust, one of the largest Indian Infrastructure Investment Trusts in the roads sector.

- Supported XpFibre to successfully raise €5.8 billion of credit facilities, marking one of the largest multi-sourced transactions in the European digital infrastructure market to date. XpFibre is the largest independent Fibre-to-the-Home (FTTH) operators in France delivering high speed internet to approximately 25% of the French territory in terms of homes passed.

- Announced an agreement to acquire Integris, a leading provider of IT services in the United States.

- Issued $3.2 billion in bonds by OMERS Finance Trust, including our inaugural AUD offering – an AUD 750 million, 5-year note.

- Announced the signing of an exclusive agreement with Maritime Transport at West Midlands Interchange in the UK.

- Participated in the US$15M Series A investment into Brightwave, an Al-powered research platform that delivers insightful and trustworthy financial analysis on demand. It was named as one of TIME magazine’s top inventions of 2024.

- Participated in two follow-on investments. The first was in Medal, an online platform that lets gamers clip and share video of their gameplay and Altana, a company that applies artificial intelligence to create a dynamic, intelligent map of the global supply chain.

- Closed our acquisition of Kenter, an energy infrastructure solutions business providing medium-voltage infrastructure and meters to over 25,000 commercial and industrial business customers in the Netherlands and Belgium.

We rotate capital out of assets with the same level of discipline with which we invest. This activity generates capital, which we deploy into future investment opportunities that align to our strategy. In 2024, we announced or completed the following realizations:

- Announced the sale of a stake in East-West Tie Limited Partnership which owns the East-West Tie Line, a 450-kilometre, 230 kV double-circuit transmission line spanning from Wawa to Thunder Bay, along the north shore of Lake Superior.

- Completed the sale of LifeLabs, a trusted provider of community laboratory tests for millions of Canadians that had been owned by OMERS since 2007.

- Completed a €182.5 million green refinancing on a comprehensively renovated Paris office asset.

- Completed the sale of its £518 million UK retail park portfolio.

- Completed the sale of CEDA, which had been majority-owned by OMERS since 2005.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0d74c32c-3c0d-4915-af73-70788746bb63

https://www.globenewswire.com/NewsRoom/AttachmentNg/136a43d0-d624-48ac-bd8c-133cd153643c