WF006: 2.85 g/t Au over 33.5 m from 64.0 m (0.083 oz/T Au over 110 ft)

Incl. 6.96 g/t Au over 10.7 m from 83.8 m (0.203 oz/T Au over 35 ft)

WF018: 1.57 g/t Au over 48.8 m from 80.8 m (0.046 oz/T Au over 160 ft)

WF012: 1.47 g/t Au over 38.1 m from 41.1 m (0.043 oz/T Au over 125 ft)

TORONTO, March 03, 2025 (GLOBE NEWSWIRE) — McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce drill results for its initial 27-hole drilling program recently completed at the Windfall Project, part of the Timberline Property near Eureka, Nevada. Highlights are shown in Table 1. McEwen Mining acquired this property as part of the Timberline Resources acquisition in 2024 (press release dated August 19, 2024).

These results, from holes drilled in Q4 2024, demonstrate the continuity of oxide gold mineralization along a 1.6-km-long (1 mile) section of the north-south-trending Windfall fault zone, including mineralization extending below the bottoms of the historical pits. In the early 1900s, underground gold mining at the Windfall Mine produced 24,000 oz of gold at a grade of 12.6 g/t Au (0.368 oz/T Au). More recently, open pit mining in the early 1980’s produced 112,000 oz gold at a grade of 1.4 g/t Au (0.041 oz/T Au) (Timberline Resources S-K 1300 report, 2023).

Table 1. Highlights from 2024 drilling at the Windfall Project. Select results grading over 0.50 g/t Au (0.015 oz/T Au) from the 27-hole program are shown. CN Ratios represent the percentage of cyanide recovery of gold in the pulp samples. Not all results are shown. Conversions from imperial to metric units may not add up exactly due to rounding.

| Drill Hole | From (m) |

To (m) |

Length (m) |

Au (g/t) |

From (ft) |

To (ft) |

Length (ft) |

Au (oz/T) |

CN Ratio % |

|

| WF001 | 56.4 | 71.6 | 15.2 | 0.68 | 185 | 235 | 50 | 0.020 | 82.7% | |

| incl. | 56.4 | 62.5 | 6.1 | 1.25 | 185 | 205 | 20 | 0.037 | 89.8% | |

| WF006 | 64.0 | 97.5 | 33.5 | 2.85 | 210 | 320 | 110 | 0.083 | 89.3% | |

| incl. | 83.8 | 94.5 | 10.7 | 6.96 | 275 | 310 | 35 | 0.203 | 88.5% | |

| and | 135.6 | 152.4 | 16.8 | 3.43 | 445 | 500 | 55 | 0.100 | 73.9% | |

| incl. | 137.2 | 144.8 | 7.6 | 5.86 | 450 | 475 | 25 | 0.171 | 60.1% | |

| WF009 | 61.0 | 71.6 | 10.7 | 2.42 | 200 | 235 | 35 | 0.071 | 89.8% | |

| WF012 | 41.1 | 79.2 | 38.1 | 1.47 | 135 | 260 | 125 | 0.043 | 87.1% | |

| incl. | 42.7 | 64.0 | 21.3 | 2.27 | 140 | 210 | 70 | 0.066 | 89.4% | |

| WF013 | 10.7 | 29.0 | 18.3 | 0.89 | 35 | 95 | 60 | 0.026 | 89.0% | |

| incl. | 10.7 | 15.2 | 4.6 | 1.88 | 35 | 50 | 15 | 0.055 | 85.0% | |

| WF014 | 7.6 | 27.4 | 19.8 | 0.56 | 25 | 90 | 65 | 0.016 | 73.7% | |

| incl. | 10.7 | 15.2 | 4.6 | 1.06 | 35 | 50 | 15 | 0.031 | 71.1% | |

| WF015 | 48.8 | 70.1 | 21.3 | 1.87 | 160 | 230 | 70 | 0.055 | 87.7% | |

| WF016 | 89.9 | 111.3 | 21.3 | 1.59 | 295 | 365 | 70 | 0.046 | 89.8% | |

| incl. | 91.4 | 102.1 | 10.7 | 2.72 | 300 | 335 | 35 | 0.080 | 91.1% | |

| WF017 | 56.4 | 73.2 | 16.8 | 0.88 | 185 | 240 | 55 | 0.026 | 88.9% | |

| WF018 | 80.8 | 129.5 | 48.8 | 1.57 | 265 | 425 | 160 | 0.046 | 63.7% | |

| incl. | 83.8 | 89.9 | 6.1 | 5.12 | 275 | 295 | 20 | 0.150 | 25.4% | |

| WF020 | 65.5 | 80.8 | 15.2 | 0.92 | 215 | 265 | 50 | 0.027 | 83.8% | |

| incl. | 68.6 | 73.2 | 4.6 | 2.23 | 225 | 240 | 15 | 0.065 | 87.9% | |

| WF025 | 76.2 | 100.6 | 24.4 | 2.03 | 250 | 330 | 80 | 0.059 | 97.6% | |

| incl. | 86.9 | 93.0 | 6.1 | 5.85 | 285 | 305 | 20 | 0.171 | 87.6% | |

| WF026 | 76.2 | 103.6 | 27.4 | 1.46 | 250 | 340 | 90 | 0.043 | 86.9% | |

| WF028 | 76.2 | 89.9 | 13.7 | 0.77 | 250 | 295 | 45 | 0.023 | 99.7% | |

| incl. | 77.7 | 83.8 | 6.1 | 1.29 | 255 | 275 | 20 | 0.038 | 91.8% | |

| WF029 | 47.2 | 67.1 | 19.8 | 0.57 | 155 | 220 | 65 | 0.017 | 79.3% | |

Figure 1 shows a location map of the Timberline Property, which includes the Lookout Mountain Project that hosts a Measured and Indicated resource containing 423,000 oz gold at a grade of 0.58 g/t Au (0.017 oz/T Au). Past open pit production in the early 1980s at Lookout Mountain was 17,700 oz of gold at a grade of 4.1 g/t Au (0.120 oz/T Au) (Timberline Resources S-K 1300 report, 2023).

Figure 1. Location map of the Timberline Property with the position of Windfall and Lookout Mountain projects. The Timberline property is about 50 km (32 miles) southeast of McEwen’s currently operating Gold Bar Mine.

Gold mineralization is contained within silicified and decalcified breccia within the steeply-east-dipping Windfall fault zone that forms the contact between the Dunderberg and Hamburg Formations. This zone of deformation and alteration extends north-south for 3.2 km (2 miles) and can be seen in the walls of the historical open pits.

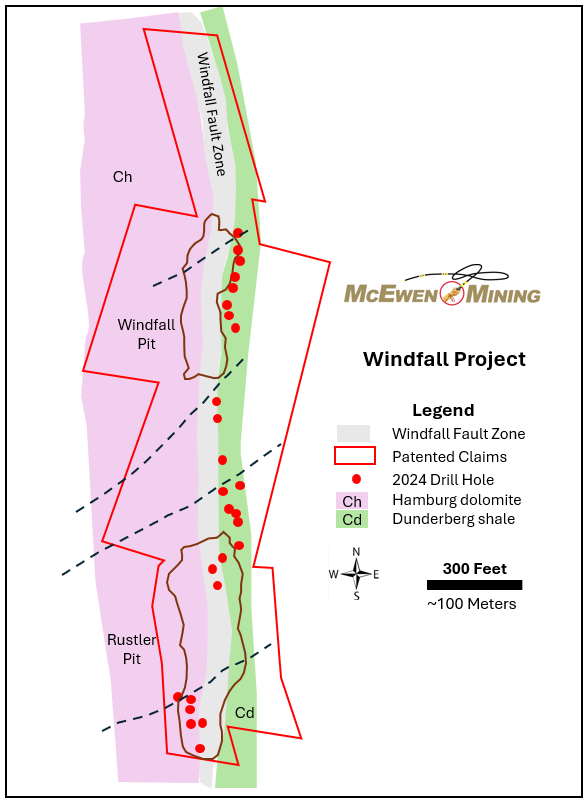

Twenty-seven reverse circulation angled holes were drilled across the fault towards the west to both evaluate and confirm the results of vertical holes drilled during the early 1980s (Figure 2). Most of the vertical historical holes were drilled nearly parallel to the fault zone, not completely testing the width of the steeply dipping mineralization. McEwen’s holes were drilled at angles to cross the Windfall fault zone and located just beneath and between the historical pits, to estimate the true width and continuity of the mineralization as close to the surface as possible (Figure 3). Many of McEwen’s holes found mineralization just below the historical pits, suggesting that gold mineralization continues from the old pits to depths of more than 100 m (300 ft) (Figure 4).

Gold mineralization is exposed in the walls of the historical pits. In drillhole intersections, the gold mineralization starts within 7.6 meters (25 ft) down-hole length and extends to greater than 152.4 meters (500 ft). Mineralization is open at depth and along strike to the north and south.

Of the 27 holes drilled by McEwen, 15 holes intersected oxidized gold mineralization grading above 0.50 g/t Au (0.015 oz/T Au) over thicknesses at least 3.0 m (10 ft) (Table 1) and 25 holes intersected gold grades above 0.15 g/t Au (0.004 oz/T Au) over thicknesses of at least 3.0 m (10 ft). Consideration for open pit mining would require ore-grade mineralization of at least 3.0 m (10 ft) in thickness.

Figure 2. Plan view map of Windfall Project with simplified geology showing the locations of McEwen’s 2024 drill hole collars along a mile-long (1.6 km) section of the Windfall fault zone (shown in grey). Gold mineralization occurs in the Windfall fault zone at the contact between the Dunderberg Formation and Hamburg Formation. This fault zone extends for more than 3.2 km (2 mi) north-south. Higher grade gold intersections occur where NE-trending faults (shown as dashed lines) intersect the Windfall fault zone. Post-mineral volcanic rocks and alluvium cover portions of the mineralized zone.

Figure 3. Map of selected results of 2024 drilling. The north-south-trending Windfall fault zone is shown in gray. Higher grade zones are found where NE-trending faults intersect the Windfall fault zone. Magenta, red and orange bars indicate the grade of gold intersections along drill hole traces. The yellow horizontal line marks where a cross section has been made across the fault zone and is shown in Figure 4 along with a plan view of the location.

Figure 4. Cross section of drill hole WF006 with 33.5 m (110 ft) grading 2.85 g/t Au (0.083 oz/T) Au within the Windfall fault zone. The two zones of gold in this hole are probably controlled by two mineralized faults.

The results of the Windfall drilling program have shown good continuity of mineralization across and along the Windfall Fault Zone, including extending from the bottom of the historical pits. Higher grade zones, localized by intersecting NE-trending faults, are targets for further drilling both laterally and down-dip. The Windfall mineralized area is located on patented claims, which are privately owned, and may allow for a shorter permitting timeline than other areas of the Timberline project. Additional drilling planned for this year aims to advance the project toward a production decision.

Technical Information

Technical Information regarding the Windfall Exploration Project contained in this news release has been prepared under the supervision of Robert Kastelic, CPG, McEwen Mining’s Exploration Manager in Nevada, who is a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 “Standards of Disclosure for Mineral Projects”.

The technical information related to resource and reserve estimates in this news release has been reviewed and approved by Luke Willis, P. Geo., McEwen Mining’s Director of Resource Modelling and a Qualified Person as defined by SEC S-K 1300 and Canadian Securities Administrators National Instrument 43-101 “Standards of Disclosure for Mineral Projects”.

New analyses reported herein were submitted as reverse circulation drill cuttings and assayed by fire assay at the accredited Paragon Geochemical Lab (ISO 17025) in Reno, Nevada. Drill holes were drilled in feet and sampled in 5-foot intervals. Conversions from imperial units to metric may not add up exactly due to rounding.

CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.’s (the “Company”) estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the Company to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, foreign exchange volatility, foreign exchange controls, foreign currency risk, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, Quarterly Report on Form 10-Q for the three months ended March 31, 2024, June 30, 2024, and September 30, 2024, and other filings with the Securities and Exchange Commission, under the caption “Risk Factors”, for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining Inc. is a gold and silver producer with operations in Nevada (USA), Canada, Mexico, and Argentina. The company also owns 46.4% of McEwen Copper, which develops the large, advanced-stage Los Azules copper project. Los Azules aims to become Argentina’s first regenerative copper mine and is committed to achieving carbon neutrality by 2038.

Focused on enhancing productivity and extending the life of its assets, the Company’s goal is to increase its share price and provide investor yield. Rob McEwen, Chairman and Chief Owner, has a personal investment in the companies of US$205 Million. His annual salary is US$1.

McEwen Mining’s shares are publicly traded on the New York Stock Exchange (NYSE) and the Toronto Stock Exchange (TSX) under the symbol “MUX”.

Want News Fast?

Subscribe to our email list by clicking here:

https://www.mcewenmining.com/contact-us/#section=followUs

and receive news as it happens!

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/9d47ad73-2c6c-4bad-845d-9ebea4d438a9

https://www.globenewswire.com/NewsRoom/AttachmentNg/ec39687a-06f8-48c5-85c0-853a83fdf696

https://www.globenewswire.com/NewsRoom/AttachmentNg/3b3db202-dfd7-438e-a790-09407a6da1ff

https://www.globenewswire.com/NewsRoom/AttachmentNg/17952287-dce2-473b-9fce-a5f81f3f1bcf