New York City, NY, Dec. 16, 2025 (GLOBE NEWSWIRE) — What Is Quantum AI?

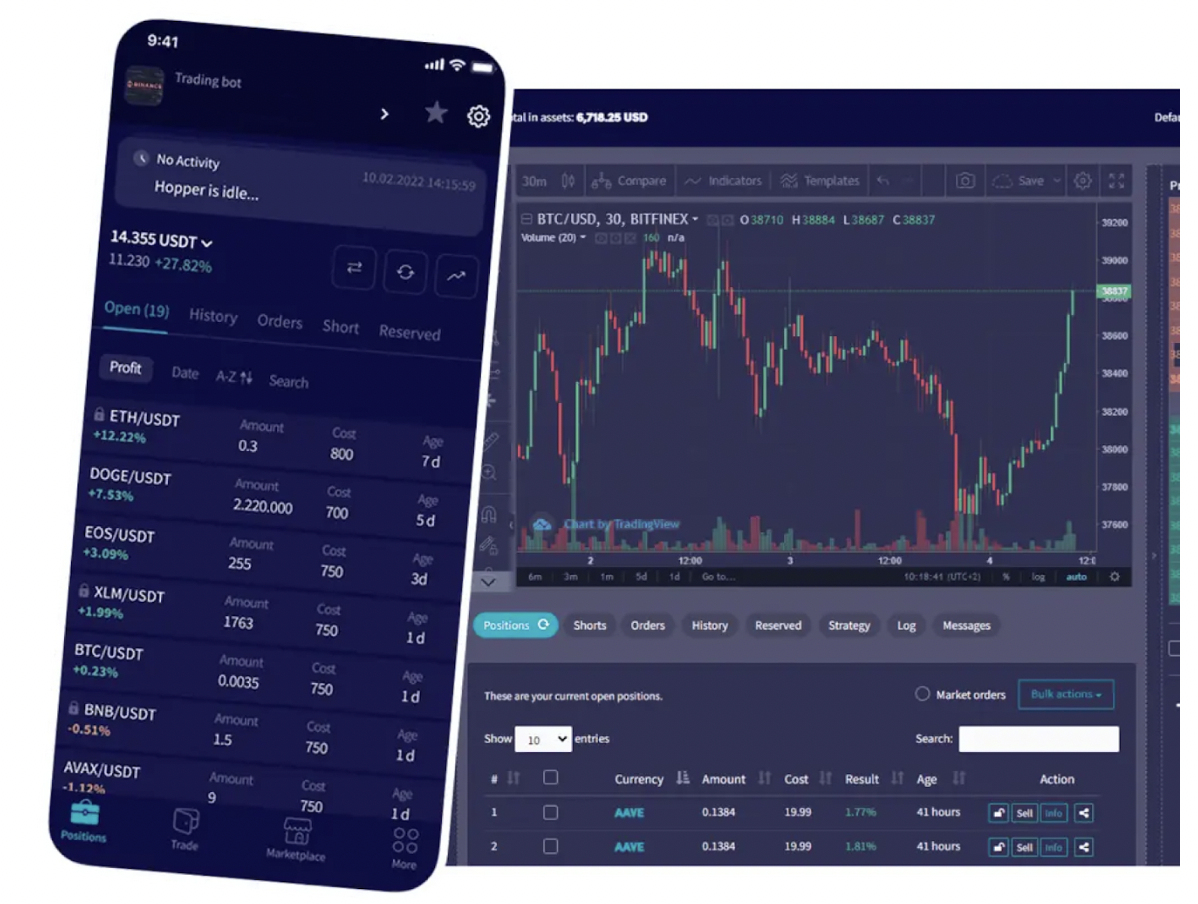

Quantum AI is a 2025 multi-asset automated trading ecosystem built on a unified infrastructure that integrates market analytics, portfolio automation, risk-optimized execution, and cross-asset access in real time. Designed as a high-performance trading engine, the platform enables users to operate across crypto, forex, indices, commodities, and equities through a single automated interface. Rather than acting as a traditional trading application, Quantum AI functions as a fully synchronized execution environment where algorithms, market data streams, and asset-routing systems operate simultaneously.

At its core, Quantum AI incorporates an adaptive automation layer capable of analyzing live market movements, volatility conditions, and liquidity shifts across multiple exchanges. This engine interprets technical indicators, real-time pricing data, and macro-level movements, enabling automated executions that align with predefined strategy settings. Its infrastructure supports dynamic portfolio rebalancing, multi-asset allocation models, and time-sensitive entry/exit timing.

The platform’s architecture is designed for global accessibility, using integrated broker channels and compliant liquidity providers to offer broad asset exposure. Quantum AI also incorporates monitored routing pathways to ensure precise order placement and reduced latency. The interface includes modules for automated trading, manual trade controls, data visualization, and customizable strategy parameters, enabling users to adapt the system to different market environments.

Join Quantum AI Now – Visit Official Website Now

Key Features of Quantum AI – Real-Time Analytics, Portfolio Automation & Global Asset Access

Quantum AI’s key features are built around three core pillars: real-time analytics, automated portfolio functionality, and expansive global asset access. Each component is engineered to function cohesively, producing a streamlined trading environment optimized for speed, accuracy, and multi-market connectivity.

The real-time analytics system continuously aggregates pricing data, volume activity, liquidity behavior, market depth, and correlation metrics from diverse exchanges. The platform converts these data streams into actionable insights using technical indicators, volatility detection models, and pattern-recognition algorithms. This ensures that users receive current market conditions without delays or reliance on external tools.

Quantum AI’s portfolio automation layer is designed to act on these insights. Through predefined strategy parameters, the automation engine can adjust trade timing, position size, risk levels, and allocation across supported assets. The system aims to maintain stability during market fluctuations by executing according to the rules set within the strategy framework. Automated processes include entry and exit execution, portfolio balancing, stop-range implementation, and momentum-triggered adjustments.

Global asset access is supported through Quantum AI’s network of regulated brokers and liquidity partners. This infrastructure connects users to crypto pairs, foreign exchange markets, equities, commodities, and index-based instruments from international marketplaces. The connectivity is built for uninterrupted data transmission, reducing the impact of latency and ensuring precise order routing.

Visit the Official Quantum AI Website Now

Why Traders Trust Quantum AI – Transparency, Speed, and Verified Performance Data

Quantum AI incorporates a transparent operational framework that emphasizes clarity in order execution, data flow, and transactional processes. Its system architecture provides users with visible logs of every executed action, including entry points, exit points, execution time stamps, routing pathways, and applied strategy parameters. This transparency ensures that all system decisions are traceable to measurable market data rather than concealed internal logic.

The platform delivers high-speed performance through distributed server routing and optimized computational pathways. Quantum AI’s execution engine is designed to reduce latency during high-volume market periods, enabling timely response to price fluctuations. This infrastructure supports automated reaction cycles where market shifts, indicator triggers, and risk-threshold adjustments are processed in real time.

Verified performance data is generated through built-in analytical reporting modules. These modules display historical strategy behavior, trade frequency distribution, volatility interaction patterns, and drawdown measurements. By providing these metrics directly within the interface, the platform ensures that users can observe the operational outcomes of automation settings without third-party interpretation.

The cost structure is also designed for transparency. Quantum AI does not impose hidden fees, and all transaction-related requirements—such as spreads, broker charges, or market-linked costs—are displayed clearly through its connected broker network. Deposit and withdrawal information is published upfront, including processing timeframes and security validations.

Security contributes to trust as well. Quantum AI uses encrypted channels for transactions, multi-tier identity verification, and monitored broker gateways to ensure data integrity across all account processes. Internal audits and consistency checks maintain system behavior under different market conditions.

By combining clear reporting, accelerated execution, secure transactional design, and openly accessible performance metrics, Quantum AI establishes a trust-focused operational environment grounded in measurable system functionality.

Register on the Quantum AI trading application

Quantum AI Account Setup Process – Step by Step

Step 1: Registration on the Official Platform

Users begin by submitting their name, email address, contact number, and secure password through the official registration form. The system encrypts submitted information and assigns a unique account identifier to initiate access creation.

Step 2: Account Verification

After registration, a verification process is completed through a partnered broker. This step ensures compliance with financial-security standards, identity validation requirements, and regional trading guidelines. Verification typically involves confirming identification documents and validating contact information.

Step 3: Minimum Deposit Requirement

Once the account is verified, users unlock the trading dashboard by making the initial minimum deposit, generally starting at $250 depending on region and associated broker terms. Deposits are processed through secure payment channels using encrypted transmission.

Step 4: Dashboard Access & System Synchronization

After the deposit is processed, the platform syncs the user’s account with real-time market data streams, analytics tools, and automation modules. The dashboard displays asset categories, strategy options, AI-driven analytics, balance information, and technical charting panels.

Step 5: Strategy Configuration

Users configure automation settings by selecting preferred risk thresholds, asset categories, allocation parameters, and timing models. These settings control how the automation engine interacts with live markets.

Step 6: Demo Mode Overview

Quantum AI includes a demo trading environment modeled with simulated market data. This environment mirrors live conditions, enabling users to test the platform’s mechanics, charting tools, and automation behavior without affecting their actual balance.

Step 7: Live Trading Activation

Once settings are finalized, users can activate live trading. The system begins monitoring real-time market conditions, executing positions, and adjusting strategies based on predefined parameters and AI-driven insights.

Unlock smarter trading with Quantum AI — Visit the Official Website Here

How Quantum AI Works – AI-Driven Market Insights & Smart Trade Execution

Quantum AI operates through a synchronized system that merges real-time analytics, machine-learning interpretation, and automated execution into a unified trading environment. The platform continuously ingests market data from diverse liquidity sources, collecting live price feeds, volatility readings, volume metrics, and order-book dynamics. This data streams into Quantum AI’s analytical engine, which interprets current market behavior using technical indicators, pattern-recognition models, and correlation-based calculations.

Once market conditions are evaluated, the platform’s automation layer applies predefined strategy parameters to determine potential actions. These parameters can include timing intervals, asset allocation rules, volatility thresholds, trend-alignment preferences, and protective risk boundaries. When conditions align with the configured strategy logic, the execution engine initiates trade actions. These actions include entry placement, incremental position adjustments, automated exits, and portfolio rebalancing.

Quantum AI’s smart execution model is supported by low-latency routing pathways that allow orders to move efficiently through partnered brokers and regulated liquidity providers. The system’s design ensures that trade execution aligns with real-time market states, reducing delays during rapid price movement. Each executed action is documented within the platform, enabling users to view time stamps, asset details, and applied logic for full process clarity.

The platform also incorporates continuous monitoring. As markets shift, Quantum AI recalculates indicator behavior, evaluates changes in trend profiles, and identifies potential reversals or momentum shifts. If conditions change, the system adjusts or closes positions according to the strategy rules. This monitoring cycle operates 24/7 across all supported assets, ensuring uninterrupted activity throughout global trading sessions.

AI Intelligence Behind Quantum AI – How Machine Learning Optimizes Every Trade

Quantum AI integrates a multi-layered AI engine designed to interpret market data, identify emerging patterns, and refine execution timing based on machine-learning principles. The system processes high-frequency data inputs from global markets and uses advanced models to recognize volatility spikes, micro-trend formation, liquidity shifts, and asset correlations. Its machine-learning algorithms adapt to changing market structures by recalibrating internal weighting systems and signal-generation thresholds.

The AI architecture consists of predictive modeling modules that assess probability-based scenarios using historical and current data sets. These modules evaluate price behavior patterns, momentum indicators, and market sentiment conditions derived from data-driven signal flows. By comparing live data to previously learned patterns, the system identifies high-probability zones for entry or exit within the chosen strategy framework.

Quantum AI’s AI engine also incorporates anomaly-detection layers that identify irregular market conditions such as sudden liquidity gaps, unexpected volume surges, or rapid trend reversals. When anomalies are detected, the system adjusts its internal risk interpretation to align with the new environment. This helps maintain stable operational behavior even during unpredictable market cycles.

Visit the Official Quantum AI Website Now

Deposits & Withdrawals – Fast, Seamless, and Fully Secure Transactions

Quantum AI structures its deposit and withdrawal systems to ensure speed, clarity, and security for all financial movements. All transaction channels are encrypted using multi-layer protocols that protect account information, payment details, and authentication data during transfer. Deposits are processed through regulated financial gateways, allowing users to fund their account using debit cards, credit cards, bank transfers, or region-specific processors depending on the partnered broker.

The minimum deposit requirement generally begins at $250, enabling immediate access to the trading dashboard once funds are confirmed. Deposits enter the account in real time or near real time, depending on the selected payment channel. Once confirmed, the platform activates data feeds, automation modules, and strategy configuration tools tied to the live account.

Withdrawals follow a structured verification procedure to ensure account security. Before funds are released, identity confirmation and payment-method matching occur through the partnered broker to comply with financial guidelines. Once approved, withdrawal requests are typically processed within 24 hours, although final bank settlement times may vary depending on region and provider.

Quantum AI maintains a transparent policy for all transactional requirements. There are no internal platform fees for withdrawing or depositing funds; however, standard brokerage or banking charges may apply depending on the user’s financial institution or regional regulations. All potential charges are displayed clearly within the account interface.

Why Choose Quantum AI? India Consumer Report Released Here

Demo Mode, Easy Registration & Low Minimum Deposit Requirements

Quantum AI includes a structured onboarding system designed to simplify account creation and provide users with a complete operational preview before engaging in live trading. The registration process requires basic account details and is completed through encrypted channels, ensuring data security from the first interaction. Once the account is created, users are connected to a partnered broker for verification according to financial compliance standards.

The platform incorporates a fully simulated demo mode powered by real-time market data streams. This environment mirrors actual market conditions while using virtual account balances, allowing users to examine system functions such as charting tools, strategy settings, analytics modules, asset categories, execution timing, and the automation engine. The demo interface is identical to the live dashboard, offering an accurate representation of platform behavior without financial risk.

Quantum AI’s low minimum deposit requirement, generally starting at $250, makes the live dashboard accessible once verification is complete. Deposits are processed using encrypted pathways, and the system immediately activates real-time data feeds and execution modules upon confirmation. This streamlined deposit structure allows users to transition from demo mode to live operation without procedural delays.

Registration, verification, and activation are supported by automated onboarding scripts that guide users through each stage. The layout includes detailed prompts, informative tooltips, and step-by-step instructions to ensure clarity throughout the setup process. The registration interface is optimized for both mobile and desktop environments, enabling users to access Quantum AI’s system from any supported device.

Quantum AI – Cost, Minimum Deposit, and Profit Structure

Quantum AI maintains a clear, structured financial model that outlines platform access requirements, operational costs, and the framework used for profit allocation within the automated environment. The system is built to ensure that every financial parameter—from minimum deposit thresholds to ongoing operational processes—remains fully transparent and aligned with regulated brokerage standards.

The minimum deposit required to access the live trading dashboard generally begins at $250, depending on regional regulations and the associated broker’s terms. This deposit activates real-time market feeds, execution modules, and strategy configuration tools, enabling the automation system to operate with full functionality. The platform does not charge internal fees for deposits or withdrawals, and all transactional costs linked to brokers, payment processors, or financial institutions are displayed clearly within the account interface.

Quantum AI itself does not impose subscription fees, maintenance charges, or usage-based costs. Any market-related fees, such as spreads or overnight positions, are determined by the partnered broker and communicated in advance through the dashboard. This ensures that every cost associated with market participation is published openly, without hidden or conditional charges.

Profit outcomes within Quantum AI are generated entirely from market performance based on the user’s chosen strategy configuration. The automation engine executes positions according to predefined parameters, and all resulting gains, adjustments, or portfolio movements are logged within the reporting module. Users retain full ownership of profits accumulated in their accounts, and these can be withdrawn through verified transaction channels at any time, subject to standard processing practices.

Future of Investing Is Here – Visit the Official Quantum AI Website Now

Countries Where Quantum AI Is Legal

Quantum AI operates through a distributed network of regulated brokers and compliance-based liquidity partners, enabling it to remain accessible in multiple regions where automated trading systems and multi-asset participation are permitted. The platform adheres to local financial guidelines through its brokerage integrations, allowing operations in jurisdictions that support algorithmic trading, AI-driven analytics, and global market connectivity.

Quantum AI is generally available in regions across Europe, parts of Asia, Australia, South America, and select markets in Africa. These jurisdictions support online trading platforms that route orders through licensed financial entities. Through its partnered brokers, Quantum AI aligns with region-specific requirements for identity verification, financial reporting, transactional transparency, and operational oversight.

Certain regions impose restrictions on automated trading services due to regulatory frameworks surrounding derivatives, leveraged instruments, or algorithmic execution. In such areas, Quantum AI is not made available until compliance pathways are established through authorized brokers. The platform’s availability is therefore determined by the local policies governing market access, automated systems, and customer verification procedures.

Quantum AI is not accessible in countries that restrict online trading or prohibit automated systems from interacting with regulated markets. Additionally, it does not operate in jurisdictions where financial service licensing for algorithmic trading platforms is still under review.

The platform continues to expand its accessibility as regulatory approvals evolve. Each region’s availability is displayed during account registration, where users are automatically routed to a compliant brokerage partner based on their location. This ensures that all operations—data routing, execution functions, and financial transactions—remain aligned with regional trading laws.

Why Choose Quantum AI? United Kingdom Consumer Report Released Here

Supported Assets & Broker Partnerships – Quantum AI Global Reach Explained

Quantum AI is engineered to operate across a wide range of asset classes through its network of regulated global brokers. This structure enables users to access diverse markets while ensuring that all executions, data transmissions, and liquidity channels meet compliance and security standards established by local authorities.

The platform supports major cryptocurrencies, including leading digital assets and high-volume trading pairs. It also provides access to foreign exchange markets, covering major, minor, and selected exotic currency pairs. Beyond forex and crypto, the system includes equities, commodities, and global indices, enabling multi-market participation within a unified automation dashboard.

Broker partnerships form the foundation of Quantum AI’s global reach. Each partnered broker is selected based on regulatory status, transactional efficiency, liquidity quality, and infrastructure reliability. These brokers handle order routing, market access, security verification, and custody of trading funds. Their compliance frameworks enable Quantum AI to operate seamlessly across jurisdictions where licensed financial intermediaries are mandatory.

Quantum AI’s asset support is structured to ensure real-time data synchronization across all categories. Market feeds are distributed through integrated routing channels, providing immediate insight into price changes, liquidity shifts, and market depth. This synchronized architecture allows the automation engine to execute positions based on accurate, uninterrupted data flow.

Join Quantum AI Now – Visit Official Website Now

Security Protocols & Broker Partnerships Behind Quantum AI

Quantum AI’s technical infrastructure is built around a multi-layer security system engineered to protect data integrity, account credentials, and transactional operations across all connected endpoints. The platform deploys advanced encryption standards for both data at rest and data transmitted through its global network. An encrypted communication tunnel ensures that algorithmic signals, financial data, and personal credentials travel through protected channels, minimizing exposure to unauthorized access or interception. Quantum AI also employs multi-factor authentication, session monitoring, and behavioral-anomaly detection to add additional layers of identity and activity verification.

Its operational environment is reinforced with continuous monitoring systems that evaluate server load, API stability, latency levels, and broker-connection integrity. These systems are automated to trigger protective responses during irregular activity or unexpected market events, ensuring that the platform maintains operational continuity. Regular protocol updates and internal stress-testing cycles support the platform’s ability to remain compliant with evolving cybersecurity requirements.

Quantum AI’s broker partnerships are structured to ensure orderly order routing and asset accessibility within regulated environments. The platform connects users to brokers that maintain established compliance frameworks, liquidity access, and transparent order-execution processes. These brokers handle trade settlement, asset custody, and account-level management while Quantum AI provides the automation and analytics layer. This separation of responsibilities helps maintain clarity in execution workflows and enhances system security by ensuring that assets remain with licensed entities while signals and strategy logic operate through Quantum AI’s AI layer.

The combined use of encryption, surveillance systems, broker-level compliance standards, and infrastructure hardening establishes Quantum AI as a platform designed to support secure and reliable automated trading activity across international markets.

Final Takeaway – Quantum AI as the Next Evolution in Automated Trading Intelligence

Quantum AI enters 2026 with a technology framework centered on algorithmic autonomy, rapid data interpretation, and scalable asset accessibility across global markets. Its system architecture is designed to integrate high-frequency analytics, machine-learning intelligence, and real-time market adaptation within a single automated environment. By combining instant signal generation with structured risk management, the platform offers an infrastructure that can respond dynamically to price movements, liquidity changes, and shifting macroeconomic conditions.

The platform’s operational transparency—supported through detailed performance logs and model-response reporting—reinforces a data-driven approach to algorithmic trading. Quantum AI’s execution engine utilizes low-latency pathways, ensuring rapid order release during peak volatility while maintaining system stability. This is complemented by security protocols that protect every layer of the trading workflow, from encrypted communication channels to broker-verified settlement processes.

Visit the Official Quantum AI Website Now

Contact:-

Quantum AI

3 John Street LU1 2JE, Luton, United Kingdom

Phone Support: +39 02 8359 1500

Email: [email protected]

Website: https://quantumai.co.com/

General Disclaimer:

The content provided in this article is for informational and educational purposes only. It does not constitute financial, legal, or professional advice. Readers are advised to consult a certified financial advisor, licensed loan officer, or legal professional before making any financial decisions. The information presented may not apply to every individual circumstance and is not intended to substitute professional judgment or regulatory guidance. The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website’s content as such. We does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Trading Disclaimer:

Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. Before deciding to trade cryptocurrency you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with cryptocurrency trading, and seek advice from an independent financial advisor. ICO’s, IEO’s, STO’s and any other form of offering will not guarantee a return on your investment.

HIGH RISK WARNING: Dealing or Trading FX, CFDs and Cryptocurrencies is highly speculative, carries a level of non-negligible risk and may not be suitable for all investors. You may lose some or all of your invested capital, therefore you should not speculate with capital that you cannot afford to lose. Please refer to the risk disclosure below. Quantum AI does not gain or lose profits based on your activity and operates as a services company. Quantum AI is not a financial services firm and is not eligible of providing financial advice. Therefore, Quantum AI shall not be liable for any losses occurred via or in relation to this informational website.

SITE RISK DISCLOSURE: Quantum AI does not accept any liability for loss or damage as a result of reliance on the information contained within this website; this includes education material, price quotes and charts, and analysis. Please be aware of and seek professional advice for the risks associated with trading the financial markets; never invest more money than you can risk losing. The risks involved in FX, CFDs and Cryptocurrencies may not be suitable for all investors. Quantum AI doesn’t retain responsibility for any trading losses you might face as a result of using or inferring from the data hosted on this site.