NEW YORK, Dec. 15, 2025 (GLOBE NEWSWIRE) — RentRedi, the fastest-growing property management software for smart real estate investors, today announced the results of its Rent Collection Survey, capturing insights from both landlords and tenants across the United States. For the first time in one of its surveys, RentRedi expanded its research to include tenants directly, reflecting the company’s belief that a healthier rental market depends on understanding both sides of the renting relationship.

This year, the context is unmistakable: many landlords are more worried about missed or late payments. What this survey – combined with RentRedi’s own platform data – shows is that the tools tenants say help them pay on time are the same tools that consistently drive stronger payment performance. Autopay, reminders, and credit reporting all point to a clear path forward for owners looking to build more reliable, repeatable rent collection processes.

And that’s what makes the RentRedi Rent Collection Survey results stand out: the data reveals strong alignment in the tools that support on-time rent payments, along with some differences in how rental owners and renters think about incentives and preferred payment methods. The results are meant to help landlords and their tenants understand each other and align their needs and wants when it comes to the most important part of the rental process: collecting and paying rent.

“Landlords are telling us they’re more worried about getting rent paid on time, and our survey gives them the insights to prevent this from happening,” said RentRedi Co-founder and CEO Ryan Barone. “What’s encouraging is that our survey shows that renters are clear about what helps them follow through: tools like autopay, automatic reminders, and credit reporting. When owners put these systems in place, they build structured operations that support everyone involved. This data gives landlords actionable insight they can use right away to improve payment consistency and ultimately run a more successful rental business.”

Rent Reminders and Autopay Lead to Better Payment Outcomes

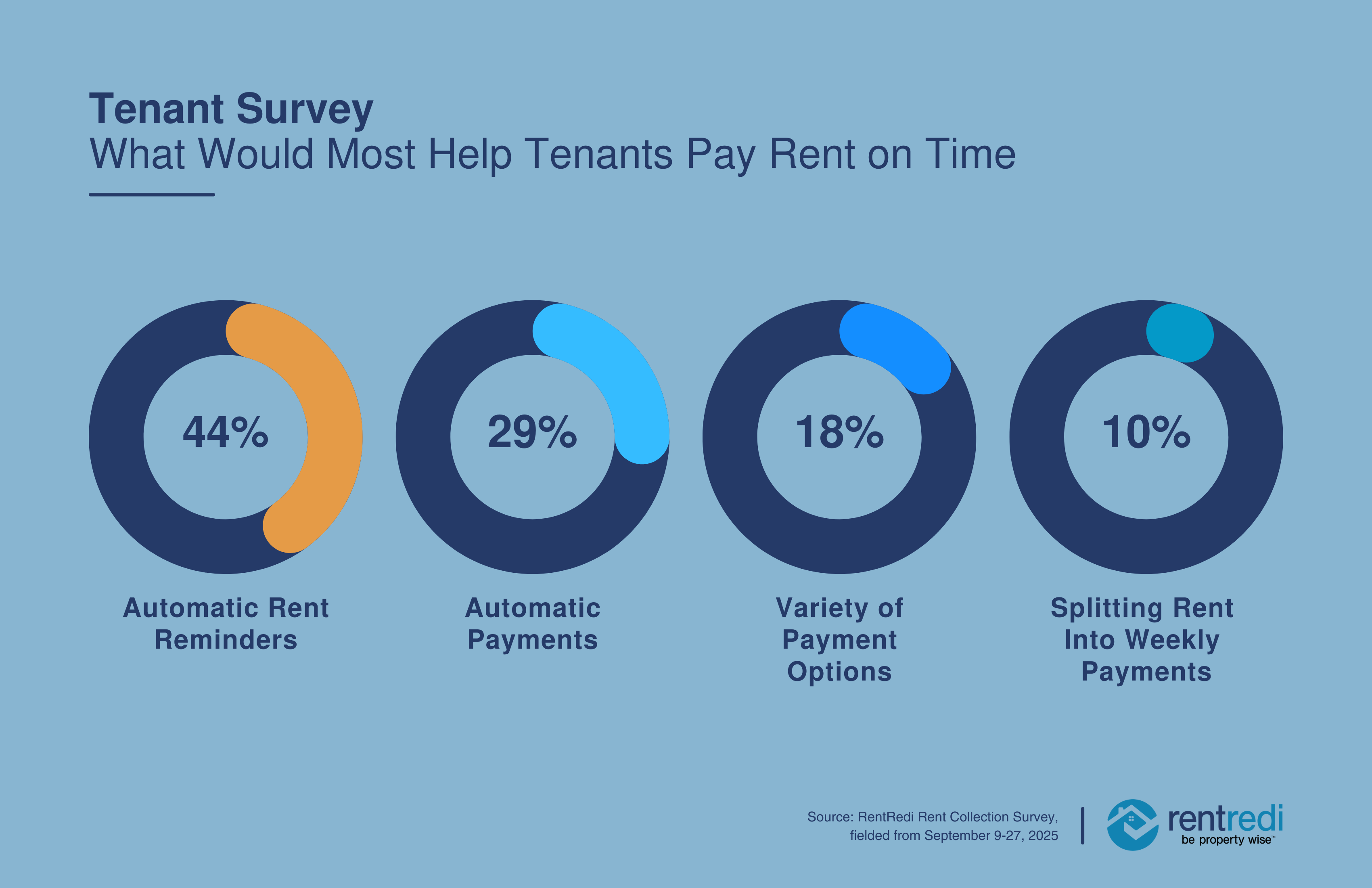

Across both groups, automatic rent reminders emerged as a key tool for on-time payments. More than half of landlords surveyed said they rely on automatic reminders to encourage timely payments. Tenants agreed, with a plurality (44%) saying reminders help them stay on schedule.

Autopay ranked as the next most helpful method for ensuring on-time rent, reinforcing how technology supports both sides in meeting expectations consistently. 41% of landlords said they offer autopay to encourage on-time payments, while nearly a third of tenants chose autopay is most likely to help them pay on-time, coming in second to automatic rent reminders.

RentRedi platform data reinforces this. Units with tenants enrolled in autopay achieve an on-time rent rate of 99%, compared with 87% for units without it. Autopay is not only preferred by tenants, but it’s one of the strongest predictors of reliable rental income.

Additionally, more than half of tenants surveyed said that having multiple ways to pay rent matters. This speaks directly to convenience, flexibility, and financial planning – core needs for today’s renters.

These findings reflect what savvy independent landlords know firsthand: steady, automated processes build a more predictable cash flow. And for tenants balancing busy lives, convenience and timely reminders create structure that helps them stay on top of rent.

How Landlords Incentivize Payments (And Why Portfolio Size Matters)

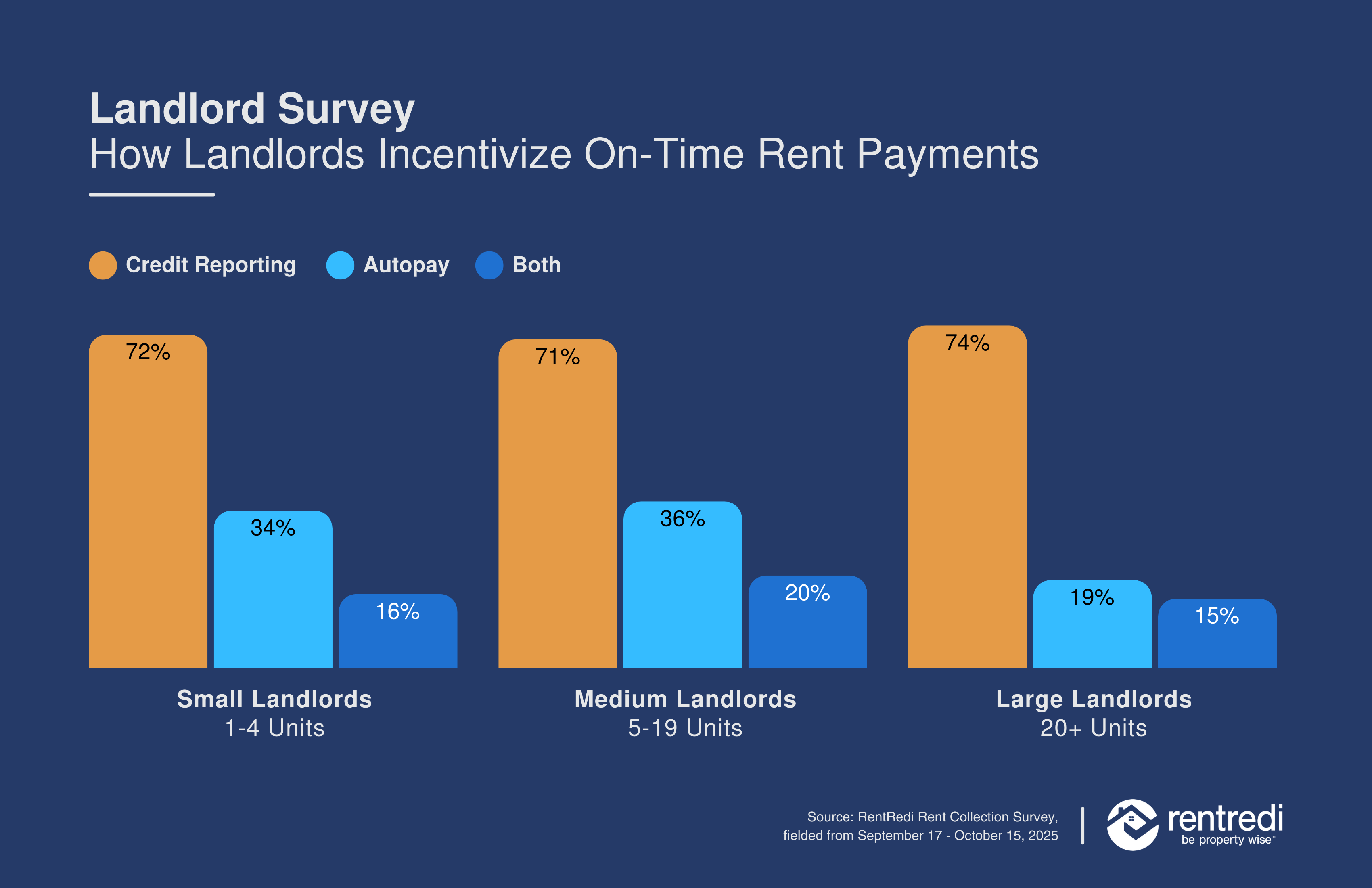

A notable trend appeared when landlords were asked about incentives: of those landlords who incentivize paying rent on time, more than 70% said they use credit reporting to encourage it. This is a smart strategy, given that internal RentRedi data shows that credit reporting is also one of the most effective tools for improving renter payment habits, leading to a 13% increase in on-time rent payments.

But autopay incentives tell a different story: only 19% of large landlords who incentivize tenants offer autopay as part of their strategy. Smaller portfolios, however, are leaning into autopay much more: 34% of small landlords and 36% of medium-sized landlords include autopay as an incentive.

Smaller owners often manage closer relationships with renters, and the data reflects their willingness to offer tools that reduce friction on both sides. The RentRedi Autopay feature supports that partnership, giving tenants control while helping owners stabilize income month after month.

RentRedi Tenants vs. the Broader Market: Digital Tools Shift Preferences

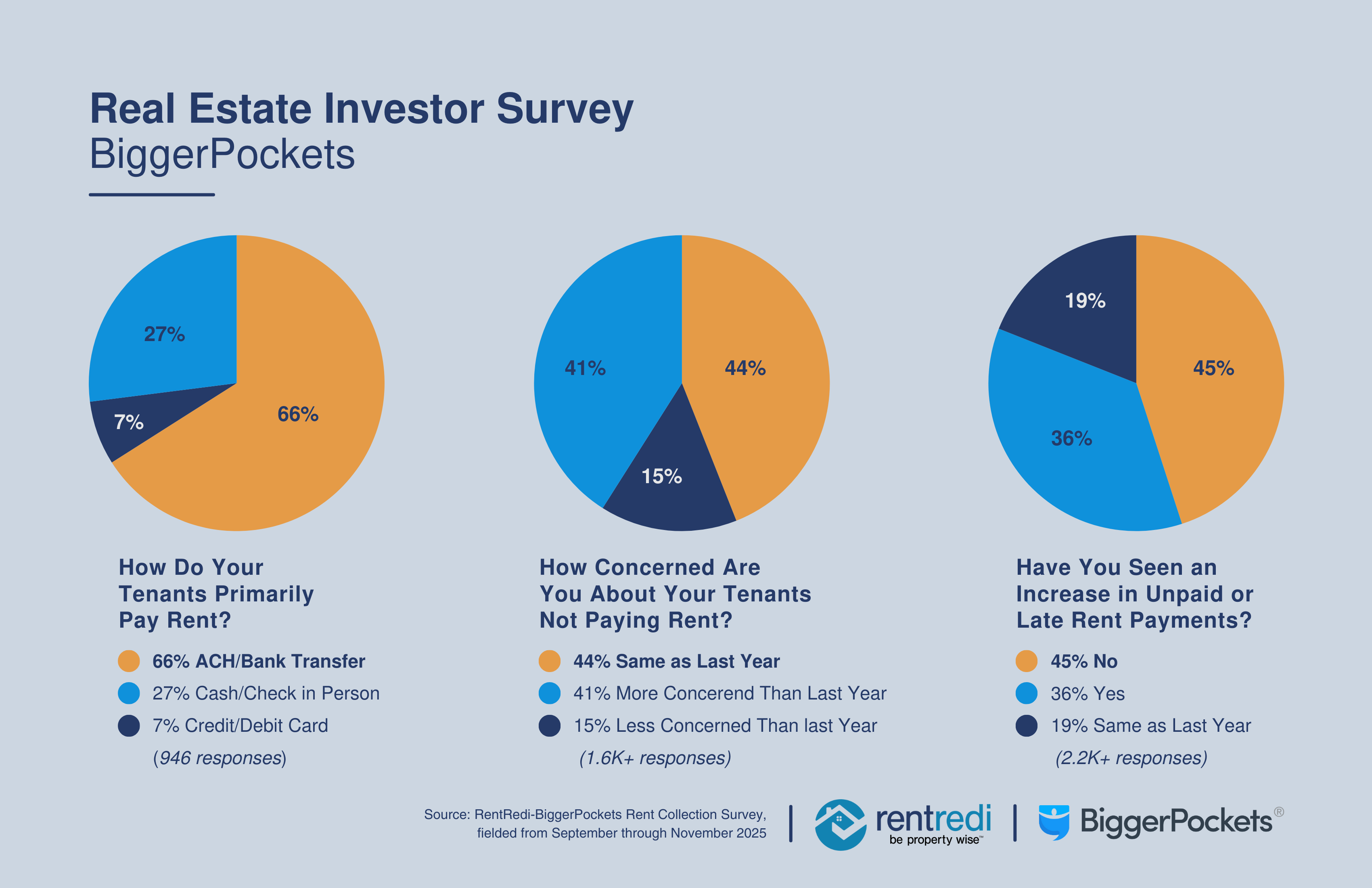

To understand how RentRedi users align with broader renting trends, RentRedi partnered with BiggerPockets on three surveys conducted from September through November 2025. The broader investor community expressed heightened concern about rent payments this year, even when many weren’t seeing an increase in late or missed rent firsthand.

Across the BiggerPockets responses:

- 41% of rental investors said they are more concerned about tenants not paying rent than last year, whereas 15% said they feel less concerned.

- When asked about actual performance, 36% said they’ve seen more unpaid or late rent in the last 12 months, while 45% reported no increase at all.

This contrast suggests landlords may be feeling the weight of a shifting economy more than their data reflects. It also reinforces why clear processes, reliable payment methods, and mobile-first tools matter so much for long-term stability.

Landlords on BiggerPockets were also asked how their tenants prefer to pay rent:

- Two-thirds reported ACH/bank transfers.

- 25% said tenants pay cash or check in person.

- 7% reported credit or debit card payments.

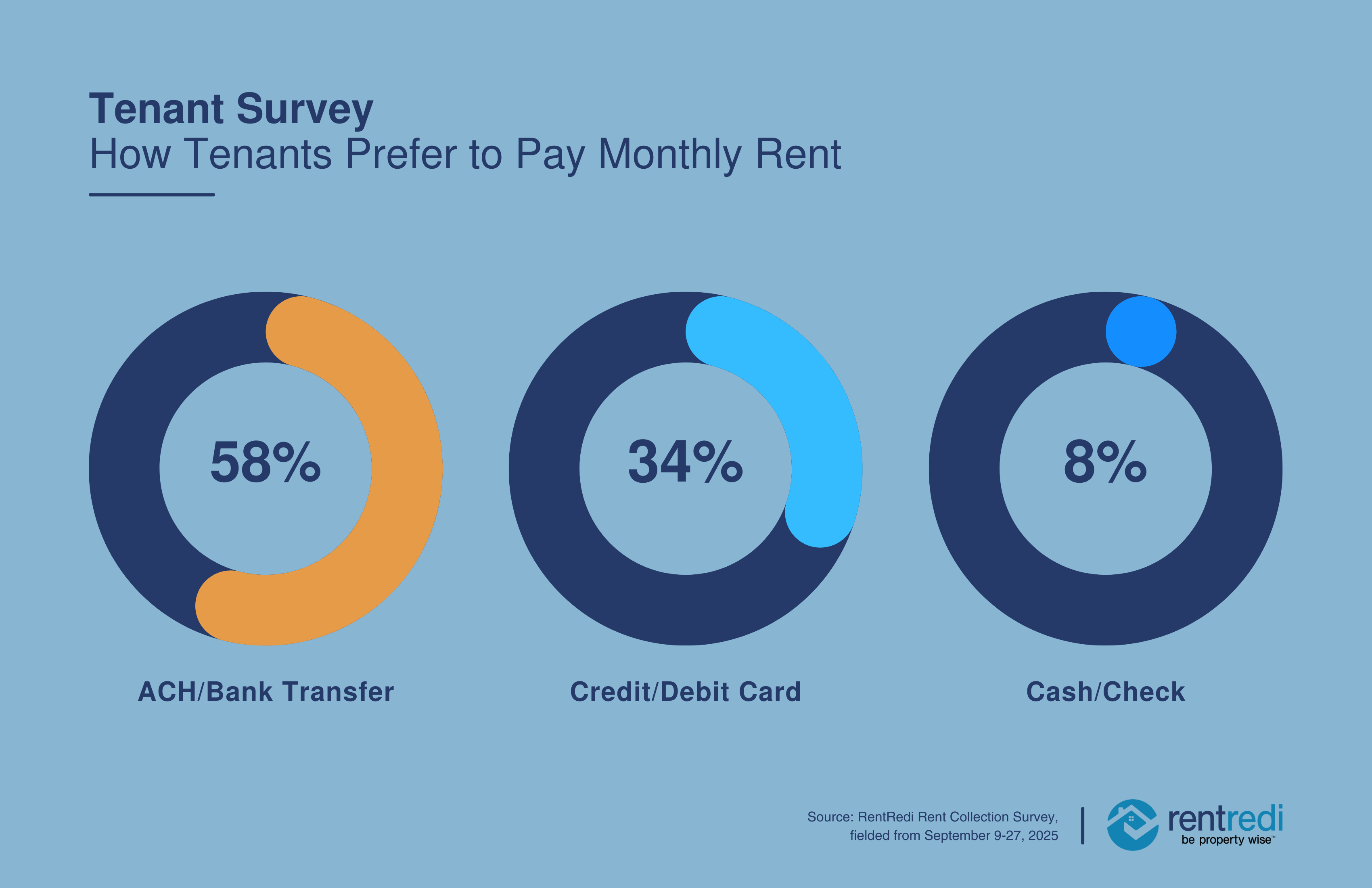

Among tenants using RentRedi, those preferences look markedly different:

- 58% prefer ACH/bank transfers.

- 38% prefer credit or debit cards.

- Only 8% prefer paying in person using cash or checks.

The disparity between the two groups is striking. RentRedi tenants are far more likely to prefer paying with credit or debit cards, while BiggerPockets investors report that card payments are used only sparingly by their tenants compared with paying with cash and checks. In fact, the preferences between paying by card and paying in person are essentially flipped between the two cohorts.

The gap highlights a simple truth: when renters have access to RentRedi’s secure, mobile platform, they naturally migrate toward more convenient digital options. Tools like bank transfers, card payments, autopay, and reminders do more than streamline rent collection – they build confidence, reduce friction, and ultimately strengthen the landlord-tenant relationship.

A Smarter Rental Ecosystem Benefits Everyone

The survey findings reinforce a clear theme: renters and rental owners are aligned more than many assume. Both value reminders, both appreciate reliable digital systems, and both benefit when payments are structured and predictable.

RentRedi helps landlords create steady processes and gives tenants confidence in managing their monthly responsibilities by providing:

- Multiple payment options

- Autopay

- Automatic reminders

- Credit reporting

- Mobile-first tools

It’s the kind of structure that improves cash flow, strengthens relationships, and supports a healthier rental housing market.

Methodology

The landlord survey ran from September 17–October 15, 2025 and had 680 respondents. Landlords were classified by real estate portfolio size as follows: small landlords (1-4 rental units); medium landlords (5-19 rental units); and large landlords (20+ rental units). The tenant survey from September 9–27, 2025 and had 1212 respondents. The joint BiggerPockets-RentRedi survey polled real estate investors through the BiggerPockets YouTube channel, capturing between 1000-2,200+ answers per question. Percentages have been rounded to the nearest whole number, and therefore the values in each barchart may not equal 100%. The full survey results can be found here.

About RentRedi

RentRedi is a comprehensive, data-powered rental management software for savvy landlords and investors. It helps people rent smarter by providing the tools and intelligence to optimize portfolios, boost retention, reduce turnover, and improve the lives of everyone in the rental process. By combining real-time data, user behavior insights, and customer feedback with a modern, intuitive interface, RentRedi delivers solutions that help real estate investors increase revenue, reduce risk, save time, minimize friction, and improve relationships. For landlords, it’s an all-in-one web and mobile app that streamlines rent collection, listings, tenant screening, lease signing, maintenance coordination, and accounting, while tenants enjoy features like online rent payment, auto-pay, credit building and boosting, and 24/7 maintenance requests.

Founded in 2016, RentRedi is VC-backed and a proven PropTech leader, recognized by the Inc. 5000, Inc. Power Partners, Fast Company’s Next Big Things in Tech, and HousingWire’s Tech100. With more than $33 billion in assets under management and nearly 300,000 landlords and tenants using its platform, RentRedi partners with leading technology providers including Zillow, TransUnion, Experian, Equifax, Realtor.com, Lessen, Thumbtack, Plaid, and Stripe to create the best customer experience possible. Learn more at RentRedi.com.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/18f4bfbf-ce69-4307-a02e-65ab205e5ee2

https://www.globenewswire.com/NewsRoom/AttachmentNg/2deddb86-f1c1-43c0-b043-9c56b763b3ff

https://www.globenewswire.com/NewsRoom/AttachmentNg/8184f893-9fef-4899-891e-3a163d80dc88

https://www.globenewswire.com/NewsRoom/AttachmentNg/7b0e668e-f38a-44da-864c-225da230dcb0

https://www.globenewswire.com/NewsRoom/AttachmentNg/d15afc54-c2c5-4b61-8c5d-0eed0290c98a