Dublin, Feb. 09, 2026 (GLOBE NEWSWIRE) — The “Latin America Data Center Construction – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026-2031)” has been added to ResearchAndMarkets.com’s offering.

The Latin America Data Center Construction market is projected to rise from USD 5.59 billion in 2025 to USD 6.05 billion in 2026, reaching USD 8.96 billion by 2031 at a CAGR of 8.19% from 2026 to 2031. This growth is driven by sovereign-cloud mandates, hyperscale campus developments by U.S. cloud leaders, and increasing AI workloads necessitating high-density facilities. Brazil leads with 40% of 2024 investments, while Mexico’s Queretaro area attracts capital due to U.S. proximity and incentives.

Mechanical infrastructure dominated 2024 spending at 38%, given the tropical climate’s cooling needs. IT infrastructure is the fastest growing segment at a CAGR of 8.52% through 2030. Tier III and Tier IV site preferences reflect the demand for fault-tolerant uptime. Supply chain issues and grid constraints extend project cycles, yet deregulation in Chile and renewable energy in Brazil, Chile, and Colombia ensure an optimistic investment climate.

Mechanical infrastructure was responsible for 37.35% of the Latin American market size in 2025, adapting to regional climate challenges. The electrical infrastructure, including essential power units and switchgear, remains crucial for financial and telecom sectors. IT infrastructure, with a focus on servers for AI, NVMe storage, and advanced networking, is the fastest-growing category at an 8.16% CAGR, driven by high-density racks and liquid cooling demands.

Tier III facilities hold a significant share, offering 99.982% availability suitable for core operations. Tier IV growth is propelled by hyperscalers and fintech requiring higher service levels, accepting higher costs for increased uptime reliability. Early partnerships with certification bodies are crucial for cost-effective compliance.

Market Trends and Insights:

- Cloud, AI, and Big Data Workloads: AI applications require more power, prompting redesigns of thermal and electrical systems. Microsoft’s USD 2.7 billion investment in Brazil and Scala’s USD 50 billion AI City highlight the scale. Local production of Delta Cube cooling systems is increasing, and AI infrastructure is seen as vital for digital competitiveness.

- Hyperscale Campus Developments: Amazon, Microsoft, and Google plan over USD 10 billion in investments by 2030, focusing on Sao Paulo, Queretaro, and Bogota. Building preparations require significant energy capacities and advanced infrastructure, with companies like V.tal allocating substantial funds for Brazil’s readiness.

- Grid Power Challenges and Electricity Costs: In Mexico, long utility interconnection queues increase reliance on diesel generators, affecting project CAPEX and OPEX. Argentina’s economic volatility exacerbates tariff risks, while transmission issues in Sao Paulo push developers to alternate locales. Operators are turning to lengthy renewable PPAs for stable pricing anyway smaller entities find these commitments challenging.

Featured Companies:

- AECOM

- Turner Construction Company

- DPR Construction

- Jacobs Solutions Inc.

- Fluor Corporation

- Skanska AB (Latin America)

- Others including Ferrovial, Grupo ACS, and ACCIONA.

Key Topics Covered:

1 INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

4.1 Market Overview

4.2 Market Drivers

4.2.1 Accelerating cloud, AI and big-data workloads

4.2.2 Hyperscale campus build-outs by US cloud majors

4.2.3 5G-driven edge-DC demand in secondary LATAM metros

4.2.4 Sovereign-cloud and data-residency regulations

4.2.5 Power-purchase-agreement (PPA) availability for renewables

4.2.6 Modular and prefabricated construction adoption

4.3 Market Restraints

4.3.1 Grid-power bottlenecks and surging electricity tariffs

4.3.2 Scarcity of Tier-III/IV-certified MEP labour

4.3.3 Water-stress curbing liquid-cooling deployments

4.3.4 Lengthy environmental licensing and community opposition

4.4 Value / Supply-Chain Analysis

4.5 Regulatory Landscape

4.6 Technological Outlook

4.7 Porter’s Five Forces

4.7.1 Bargaining Power of Suppliers

4.7.2 Bargaining Power of Consumers

4.7.3 Threat of New Entrants

4.7.4 Threat of Substitutes

4.7.5 Intensity of Competitive Rivalry

4.8 Key Latin America Data Center Construction Statistics

4.8.1 Data Centers Total Installed Capacity (MW) in the Latin America, 2023 and 2024

4.8.2 Total IT Load Under Construction in the Latin America, MW, 2025 – 2030

4.8.3 Average Capex and Opex for the Latin America Data Center Construction

4.8.4 Top Capex Spenders on Data Center Infrastructure in Latin America

5 MARKET SIZE AND GROWTH FORECASTS

5.1 By Infrastructure

5.1.1 By Electrical Infrastructure

5.1.1.1 Power Distribution Solutions

5.1.1.1.1 Power Distribution Unit

5.1.1.1.2 Switchgears

5.1.1.1.3 Others Electrical Infrastructure

5.1.1.2 Power Backup Solutions

5.1.1.2.1 UPS

5.1.1.2.2 Generators

5.1.2 By Mechanical Infrastructure

5.1.2.1 Cooling Systems

5.1.2.1.1 Liquid-based Cooling

5.1.2.1.2 Air-based Cooling

5.1.2.2 Racks and Cabinets

5.1.2.3 Other Mechanical Infrastructure

5.1.3 By IT Infrastructure

5.1.3.1 Servers

5.1.3.2 Storage

5.1.3.3 Other IT Infrastructure

5.1.4 General Construction

5.1.5 Services

5.1.5.1 Design and Consulting

5.1.5.2 Integration

5.1.5.3 Support and Maintenance

5.2 By Tier Standard

5.2.1 Tier I and II

5.2.2 Tier III

5.2.3 Tier IV

5.3 By End-User Industry

5.3.1 Banking, Financial Services and Insurance

5.3.2 IT and Telecommunications

5.3.3 Government and Defense

5.3.4 Healthcare

5.3.5 Other End Users

5.4 By Data Center Type

5.4.1 Colocation Data Centers

5.4.2 Hyperscale / Self-built Data Centers

5.4.3 Others (Enterprise / Edge / Modular)

5.5 By Geography

5.5.1 Brazil

5.5.2 Chile

5.5.3 Argentina

5.5.4 Rest of Latin America

6 COMPETITIVE LANDSCAPE

6.1 Market Share Analysis

6.2 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

6.2.1 AECOM

6.2.2 Turner Construction Company

6.2.3 DPR Construction

6.2.4 Jacobs Solutions Inc.

6.2.5 Fluor Corporation

6.2.6 Skanska AB (Latin America)

6.2.7 Ferrovial S.A.

6.2.8 Grupo ACS (Dragados)

6.2.9 ACCIONA Construccion

6.2.10 Andrade Gutierrez Engenharia

6.2.11 Camargo Correa Infra

6.2.12 Novonor (Odebrecht Engenharia)

6.2.13 Queiroz Galvao S.A.

6.2.14 Techint EandC

6.2.15 Sacyr Ingenieria e Infraestructuras

6.2.16 Mota-Engil LATAM

6.2.17 Constructora Norberto Odebrecht LatAm

6.2.18 Grupo Carso Infraestructura

6.2.19 COSAPI Ingenieria y Construccion

6.2.20 Constructora Colpatria

6.2.21 Grupo Marhnos

6.2.22 Constructora Sudamericana

6.2.23 Ghella S.p.A.

6.2.24 Besix Watpac

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

7.1 White-space and Unmet-Need Assessment

For more information about this report visit https://www.researchandmarkets.com/r/93k6rx

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

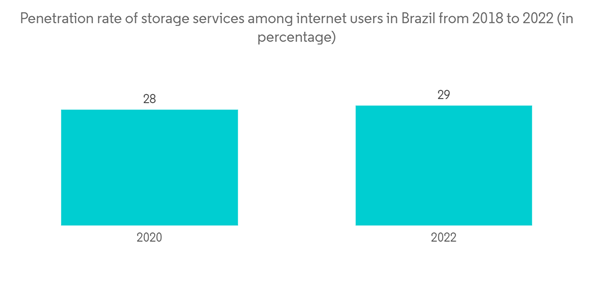

- Latin America Data Center Construction Market Penetration Rate Of S

- Latin America Data Center Construction Market Internet Users As Sha