Dublin, Jan. 08, 2024 (GLOBE NEWSWIRE) — The “Global Edible Offal Market Size, Share & Industry Trends Analysis Report By Application, By Distribution Channel, By Source (Pig, Goat, Sheep, Cattle, Poultry, Horse and Others), By Regional Outlook and Forecast, 2023 – 2030” report has been added to ResearchAndMarkets.com’s offering.

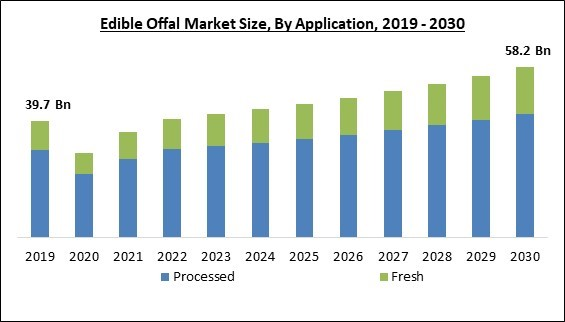

The Global Edible Offal Market size is expected to reach $58.2 billion by 2030, rising at a market growth of 4.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 13,319.2 Kilo Tonnes, experiencing a growth of 2.3% (2019-2022).

Young people and millennials, as savvy consumer groups, are inclined to order food and goods online, particularly in times of epidemic/pandemic. Therefore, the Online Sales segment registered $2,386.6 million revenue in the market in 2022.

These clients are extremely comfortable and excited about technology and have a long-standing practice of shopping online. As a result of these changes, numerous manufacturers have formed partnerships with various independent online merchants to boost product visibility and overall sales. Some of the factors impacting the market are rising awareness of nose-to-tail eating, low prices of offal, and increase in popularity of veganism.

Eating an animal from head to tail ensures that any components that might otherwise go to waste are used to create delicious dishes. This method of cooking and eating goes back to an earlier time when humans made sure to use every priceless component of every animal killed for its meat. Moreover, due to its unique flavors and textures, offal has traditionally been considered less appetizing in many cultures. Since there is typically less demand for these cuts, prices may decline.

Prime pieces of beef are often less accessible than offal. Each animal produces a variety of offal. Thus, there is a wider supply, which can result in lower prices. By-products of the meat processing sector frequently include offal. Various animal parts are left over when an animal is killed for its meat. Offal is more accessible for lower or middle-income people who cannot afford to consume relatively expensive meat products. Thus, the idea of “nose-to-tail” dining, when taken into account, and rise in offal demand, particularly among low- and middle-income groups are crucial factors fueling the demand for edible offal.

However, there are more delicious vegetarian and vegan alternatives than ever before, which is one of the reasons more people are cutting down on their use of animal products. Demand for vegan meals is rising due to growing public awareness of the harmful health impacts of consuming animal products and the unethical and immoral effects of animal agriculture.

Many people support veganism due to its potential benefits for health, animal welfare, weight control, environmental preservation, and the reduction of antibiotic consumption. To improve their health and general well-being, people have been looking for communities of people who have similar eating habits. The demand for edible offal would decrease when more people decide to adopt a vegan diet, which would impede market expansion.

Application Outlook

On the basis of application, the market is fragmented into fresh and processed. In 2022, the processed segment held the highest revenue share in the market. Offal’s flavor profile can be improved by processing it into different forms and using it in processed meat products. Offal gives products a distinctive flavor and richness that appeals to customers looking for unique and savory flavors.

Processed Outlook

Under processed segment, the market is sub-segmented into canned/brine, frozen, sausage/bagged, and others. In 2022, the canned/brine segment registered the highest revenue share in the market. Offal preserved in cans or tins is referred to as canned offal. It is cooked or uncooked, chopped, and packaged into cans for long-term storage. The demand for protein-rich and convenient foods has significantly increased over the past few years due to growing health consciousness, and the trend is expected to continue throughout the projection period.

Distribution Channel Outlook

By distribution channel, the market is classified into food service and retail. In 2022, the food service segment witnessed the largest revenue share in the edible offal market. The demand for offal in the food service industry is expected to increase due to the increased demand for fine dining establishments and the rising consumption of organic meats. Many restaurants use complete animal carcasses, including offal, to enhance flavors and minimize waste.

Retail Outlook

Under the retail segment, the market is further divided into online sales, hypermarkets/supermarkets, wholesale stores, and others. In 2022, the hypermarkets/supermarkets segment generated the highest revenue share in the edible offal market. Manufacturers and prominent brands are expanding their product categories in response to the rising amount of grocery shoppers at major supermarkets such as Tesco, Aldi, Target, and Walmart. These companies are doing this by supplying fresh and frozen options for customers shopping in supermarkets and hypermarkets.

Source Outlook

Based on source, the market is segmented into cattle, goat, pig, sheep, poultry, horse, and others. In 2022, the pig segment dominated the market with the maximum revenue share. Utilizing pig offal helps maximize the use of the entire pig carcass and decrease food waste. This supports consumer awareness of food waste and the desire to have a minimal adverse effect on the environment; it assists in clarifying the demand for pig offal.

Regional Outlook

In 2022, the Asia Pacific region led the edible offal market by generating maximum revenue share. Asia Pacific is the residence of a significant portion of the world’s population. The demand for various food products, including offal, has expanded due to the growing population, rising wealth, and urbanization. Retailers and suppliers have the opportunity to meet the growing demand for offal in the region owing to this developing market.

Key Market Players

- Vion N.V. (Stichting Administratiekantoor SBT)

- Hormel Foods Corporation

- Itoham Yonekyu Holdings Inc.

- JBS USA Holdings, Inc. (JBS S.A)

- Marfrig Global Foods S.A.

- NH Foods Ltd.

- OSI Group, LLC

- Sysco Corporation

- The Kraft Heinz Company

- Cargill, Incorporated

Scope of the Study

By Application (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Processed

- Canned/Brine

- Frozen

- Sausage/bagged

- Others

- Fresh

By Distribution Channel (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Food Service

- Retail

- Hypermarkets/supermarkets

- Wholesale Stores

- Online Sales

- Others

By Source (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Pig

- Goat

- Sheep

- Cattle

- Poultry

- Horse

- Others

By Geography (Volume, Kilo Tonnes, USD Million, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Egypt

- South Africa

- Nigeria

- Rest of LAMEA

For more information about this report visit https://www.researchandmarkets.com/r/wut03t

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

- edible-offal-market-size.jpg

- edible-offal-market-size.jpg