TORONTO, Feb. 05, 2026 (GLOBE NEWSWIRE) — DPM Metals Inc. (TSX: DPM, ASX: DPM) (ARBN: 689370894) (“DPM” or “the Company”) is pleased to announce an update to the Mineral Resource and Mineral Reserve (“MRMR”) estimate and life of mine (“LOM”) plan for its Chelopech mine in Bulgaria.

Highlights

(All dollar amounts in this news release are expressed in U.S. dollars, unless otherwise noted.)

- Mine life extended to 10 years: Based on the updated Mineral Reserve estimate, mine life extends to 2036 for sustained average production levels of approximately 160,000 gold equivalent ounces (“GEO”) per year.1

- Increased Mineral Reserves: Proven and Probable Mineral Reserves increased to 23.2 million tonnes (“Mt”). Relative to the previous Mineral Reserve estimate, this represents a net increase of 42% in tonnage and increase in metal content of 12% for gold and 10% for copper. The updated Mineral Reserve estimate incorporates the Sharlo Dere prospect, updated model and design parameters as well as updated cut-off calculation assumptions.

- Mineral Resource base supports additional life extension potential: Measured and Indicated Mineral Resource tonnage, exclusive of Mineral Reserves, increased by 20% to 15.3 Mt, with grades of 1.96 g/t gold and 0.57% copper, in line with Mineral Reserve grades.

- Attractive value potential from Wedge discovery: The MRMR estimate does not include the Wedge Zone Deep (“WZD”) discovery, located within the northern flank of the Chelopech mine concession and approximately 300 metres below existing Mineral Reserves and current mine infrastructure, or prospectivity of the Chelopech North and Brevene exploration licences. An update on drilling results from WZD is expected in the second quarter of 2026.

“Our updated Mineral Reserve estimate, which extends Chelopech’s mine life to 10 years, is a strong indication of Chelopech’s track record of replacing Mineral Reserves, and we believe there is potential to continue this trend going forward,” said David Rae, President and Chief Executive Officer of DPM Metals.

“We continue to be excited by the Wedge Zone Deep discovery, which underscores the potential at our core operation to add high-grade Mineral Resources within the Chelopech mine concession, extend mine life and enhance long-term value for all stakeholders.”

Updated Mineral Reserve and Resource Estimate

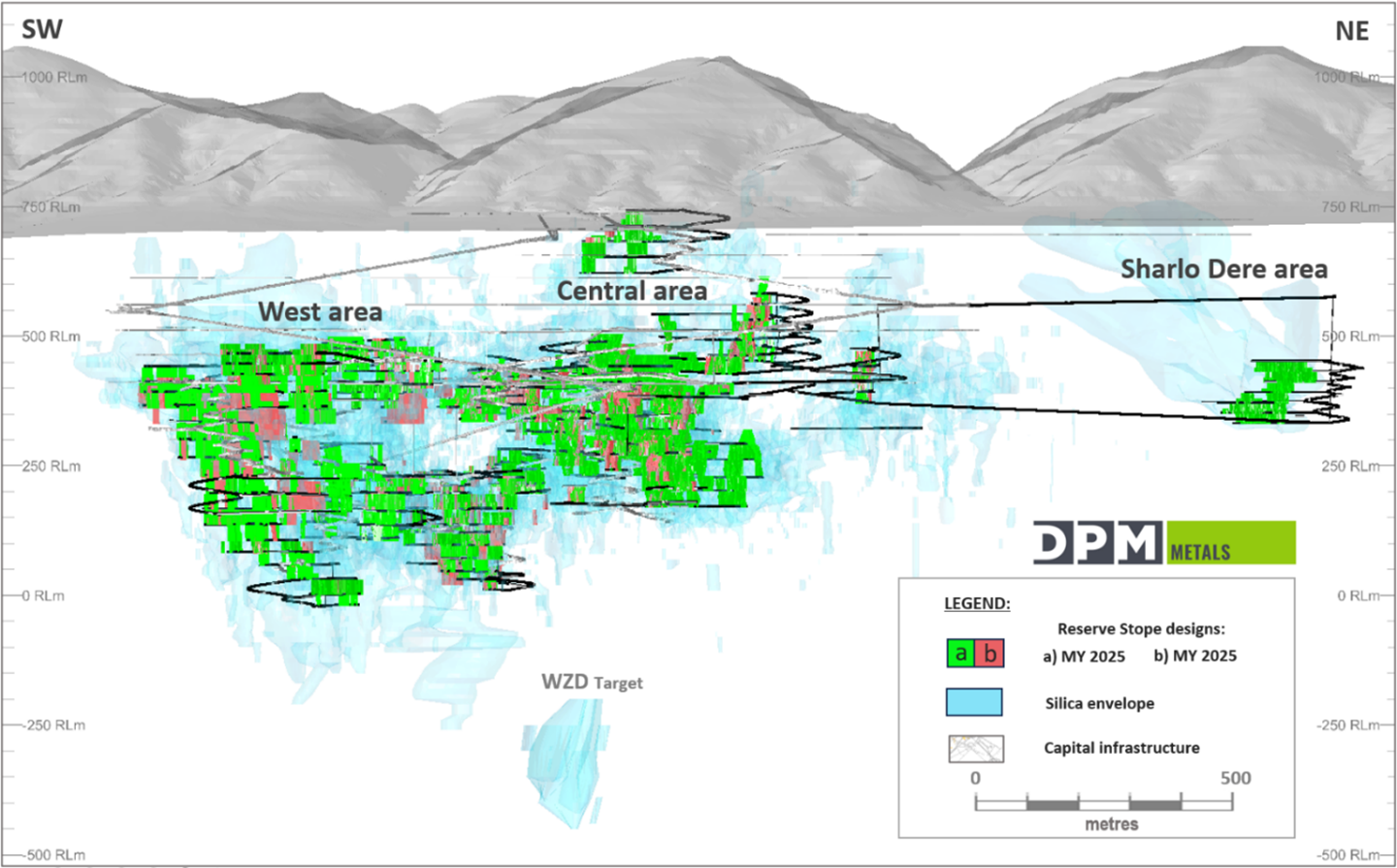

The 2025 MRMR estimate reflects updated Mineral Resource estimation parameters as well as updated cut-off calculation assumptions, and is effective as at May 31, 2025. Mineral Resources have been updated to include new geologic information from the Company’s drilling programs, updated modelling and estimation parameters, as well as the addition of the Sharlo Dere prospect (see Figure 1).

Updated cut-off assumptions were applied to the Net Smelter Return (“NSR”) calculation, which have been updated to reflect new recovery models based on process plant operational data and updated cost and price information.

Figure 1. Plan view of the Chelopech deposit showing the location of key mining blocks as well as the Sharlo Dere Prospect and WZD target

The Proven and Probable Mineral Reserves increased by 6.9 Mt of ore with contained gold increasing by 174,000 ounces and contained copper increasing by 28 Mlbs. relative to the previous Mineral Reserve estimate as of May 31, 2024.

The updated Proven and Probable Mineral Reserve estimate for Chelopech of 1.6 Moz. of gold and 308 Mlbs. of copper supports a mine life that extends to 2036 and sustains production at an average rate of approximately 160,000 GEO2 per year. This does not include the potential for further conversion of existing Mineral Resources and potential additions through ongoing exploration success, including the recent discovery of the WZD target, an area of high-grade mineralization located on the current Chelopech mine concession, adjacent to existing Mineral Reserves.

The Sharlo Dere prospect includes a Mineral Reserve inventory of 650,000 tonnes at a grade of 1.49 g/t gold and 0.52% copper. DPM has progressively developed the Sharlo Dere prospect by way of inclined surface diamond drill testing, which has been tested to an approximate 30-metre by 30-metre drill spacing. The prospect has analogous metallurgical characteristics to the main mining areas and metallurgical testing has confirmed it is amenable to the Chelopech flowsheet. The prospective trend at Share Dere extends beyond the Chelopech mine concession, onto the adjacent Chelopech North Concession, which is expected to be granted in 2026.

The updated Mineral Reserves estimate is shown below:

| Chelopech Mine Mineral Reserve Estimate (As of May 31, 2025) |

|||||||

| Classification | Tonnes (Kt) | Grade | Metal Content | ||||

| Au (g/t) | Ag (g/t) | Cu (%) | Au (Koz.) | Ag (Koz.) | Cu (Mlbs.) | ||

| Proven | 6,977 | 2.14 | 6.22 | 0.61 | 479 | 1,396 | 94.57 |

| Probable | 16,232 | 2.20 | 9.27 | 0.60 | 1,149 | 4,836 | 213.81 |

| Total | 23,209 | 2.18 | 8.35 | 0.60 | 1,628 | 6,231 | 308.38 |

- The Mineral Reserves disclosed herein have been estimated in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014).

- Mineral Reserves has been depleted for mining as of May 31, 2025.

- The Inferred Mineral Resources do not contribute to the financial performance of the project and are treated in the same way as waste.

- The reference point at which the Mineral Reserves are defined is where the ore is delivered to the crusher.

- Long-term metal prices assumed for the evaluation of the Mineral Reserves are $2,300/oz for gold, $23.00/oz for silver, and $3.50/lb for copper.

- Mineral Reserves are based on an NSR-less-costs cut-off value of $0/t. The total cost applied was approximately $61/t which is a sum of operational costs of approximately $53/t and sustaining capital of approximately $7/t.

- All blocks include an NSR formula that differentiates the main mineralization types. The NSR formula utilises long term metal price, metallurgical recoveries, payability terms, treatment charges, refining charges, penalty charges (deleterious arsenic), concentrate transport costs, and royalties.

- Mineral Reserves account for unplanned mining dilution and ore loss by orebody dimension and experience per mining block area. The average values are 6.9% for unplanned ore loss and 7.4% for unplanned dilution.

- Mineral Reserves account for planned mining dilution and mining recovery through stope optimisation and stope design. The stopes are optimised to maximise net cashflow within the constraints of dilution and orebody extractable geometry. The planned dilution and recovery alter depending on geotechnical, mineralisation continuity controls and ore zone dimensions. All stopes have been verified that they are profitable after the application of the cost of capital development.

- There is no known likely value of mining, metallurgical, infrastructure, permitting or other relevant factors that could materially affect the estimate. The final seven years of operation occurs after the termination of the mining concession agreement. It is the opinion of DPM that the mining permit will be extended.

- The Proven Mineral Reserve includes broken stocks of 42 Kt at 1.73 g/t Au, 4.25 g/t Ag and 0.41% Cu as well as stockpiles of 8 Kt at 2.84 g/t Au, 5.75 g/t Ag and 0.68% Cu.

- Sum of individual values may not equal due to rounding.

Measured and Indicated Mineral Resources, exclusive of Mineral Reserves, show a net increase of 2.6 Mt, and a decrease of 52,000 ounces of gold and 29 Mlbs. of copper relative to the 2024 Mineral Resource estimate. The decrease was largely a result of conversion of Mineral Resources to Mineral Reserves as well as the updated cut-off calculation assumptions.

Further to this, Inferred Mineral Resources increased by 6.2 Mt containing 333,000 ounces of gold and 65 Mlbs. of copper relative to the previous estimate. This is a result of the updated cut-off calculation assumptions as well as the downgrading of a portion of the Mineral Resource in the upper levels of the mine, based on updated modelling of historically mined areas. Further drilling is planned to determine the extents of these mineralized zones and to determine the geotechnical conditions around the historic mining areas.

The Mineral Resource estimate, reported exclusive of Mineral Reserves, is shown below and is effective as at May 31, 2025:

| Chelopech Mineral Resource Estimate (As of May 31, 2025) |

|||||||

| Resource Category | Tonnes (Mt) | Grades | Metal Content | ||||

| Au (g/t) | Ag (g/t) | Cu (%) | Au (Moz.) | Ag (Moz.) | Cu (Mlbs.) | ||

| Measured | 8.1 | 2.32 | 8.05 | 0.72 | 0.604 | 2.096 | 129 |

| Indicated | 7.2 | 2.03 | 10.47 | 0.56 | 0.470 | 2.424 | 89 |

| Total Measured and Indicated | 15.3 | 2.18 | 9.19 | 0.64 | 1.072 | 4.521 | 216 |

| Inferred | 9.1 | 1.96 | 9.38 | 0.57 | 0.573 | 2.744 | 114 |

- The Mineral Resources disclosed herein have been estimated in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves (CIM, 2014).

- Tonnages are rounded to the nearest 0.1 Mt to reflect that this is an estimate.

- Metal content is rounded to the nearest 1 thousand ounces or 1 Mlbs. to reflect that this is an estimate.

- The Mineral Resources are reported exclusive of Mineral Reserves.

- Long-term metal prices assumed for the evaluation of the Mineral Resources are $2,500/oz for gold, $26.00/oz for silver, and $3.85/lb for copper.

- Mineral Resources are based on a NSR-less-costs cut-off value of $0/t in support of reasonable prospects of eventual economic extraction. It is on average $61/t which is a sum of operational costs of approximately $53/t and sustaining capital of approximately $7/t.

- All blocks include an NSR formula that differentiates the main mineralization types. The NSR formula utilizes long term metal price, metallurgical recoveries, payability terms. treatment charges, refining charges, penalty charges, concentrate transport costs, and royalties.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Sum of individual values may not equal due to rounding.

Life of Mine Plan

The following table outlines the updated LOM plan, reflecting the updated Mineral Reserve estimate. After testing a range of different scheduling scenarios, the selected plan best meets production goals and optimizes net asset value by maintaining a 2.2 Mt per year mining rate through to 2032, optimized within development rate constraints.

This LOM plan will be the basis for DPM’s 2026 guidance and updated three-year outlook, to be announced on February 10, 2026, along with the Company’s fourth quarter and year-end 2025 financial results.

For comparison, the current LOM plan, as well as the 2022 LOM plan, are illustrated below:

| Current Life of Mine Plan1 | |||||||||||||

| Metric | Unit | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | Total / average |

| Ore processed | Mt | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.2 | 2.0 | 2.0 | 1.8 | 0.7 | 21.9 |

| Grade | |||||||||||||

| Au | g/t | 2.63 | 2.93 | 2.19 | 2.09 | 2.01 | 1.75 | 1.97 | 1.9 | 1.86 | 1.83 | 1.72 | 2.11 |

| Cu | % | 0.79 | 0.65 | 0.64 | 0.6 | 0.54 | 0.6 | 0.55 | 0.53 | 0.52 | 0.48 | 0.48 | 0.59 |

| Ag | g/t | 7.2 | 9.4 | 7.0 | 6.0 | 7.4 | 10.4 | 11.3 | 11.1 | 9.3 | 6.3 | 4.6 | 8.4 |

| Recoveries | |||||||||||||

| Copper Concentrate | |||||||||||||

| Au | % | 65.1 | 57.8 | 60.5 | 58.5 | 51.7 | 66 | 64.9 | 61.7 | 52.2 | 51.1 | 58.9 | 59.2 |

| Cu | % | 85.6 | 79.7 | 83.5 | 83.2 | 79.3 | 83.9 | 81.1 | 79.6 | 77.8 | 78.2 | 83.1 | 81.6 |

| Ag | % | 48.2 | 39.8 | 44.4 | 43.9 | 37.9 | 43.4 | 40.2 | 38.7 | 36.4 | 38.2 | 44.6 | 41.0 |

| Pyrite Concentrate | |||||||||||||

| Au | % | 20.3 | 21.9 | 23.3 | 25.4 | 29.2 | 14 | 10.9 | 11.3 | 24.6 | 28.4 | 24.3 | 21.1 |

| Production | |||||||||||||

| Au | Koz. | 159 | 165 | 130 | 124 | 115 | 99 | 106 | 89 | 92 | 84 | 30 | 1,193 |

| Cu2 | Mlbs. | 33 | 25 | 26 | 24 | 21 | 24 | 21 | 19 | 18 | 15 | 6 | 231 |

| Ag3 | Koz. | 247 | 265 | 220 | 187 | 198 | 319 | 322 | 276 | 217 | 138 | 43 | 2,432 |

| Total GEO4 | Koz. | 205 | 206 | 175 | 169 | 154 | 146 | 148 | 126 | 126 | 113 | 41 | 1,609 |

| Previous Life of Mine Plan | |||||||||||||

| Metric | Unit | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2035 | 2036 | Total / average |

| Ore processed | Mt | 2.1 | 2.1 | 2 | 1.8 | 1.8 | 1.8 | 1.2 | – | – | – | – | 12.7 |

| Grade | |||||||||||||

| Au | g/t | 2.87 | 3.04 | 2.8 | 2.69 | 2.47 | 2.58 | 2.38 | – | – | – | – | 2.72 |

| Cu | % | 0.91 | 0.7 | 0.75 | 0.74 | 0.72 | 0.77 | 0.76 | – | – | – | – | 0.77 |

| Ag | g/t | 8.52 | 8.33 | 9.51 | 7.94 | 7.59 | 8.11 | 11.3 | – | – | – | – | 8.62 |

| Recoveries | |||||||||||||

| Copper Concentrate | |||||||||||||

| Au | % | 57.1 | 52.8 | 54.3 | 55.5 | 56.5 | 63.1 | 63 | – | – | – | – | 56.8 |

| Cu | % | 84.9 | 81.8 | 83.3 | 83.7 | 84.4 | 87.1 | 86.7 | – | – | – | – | 84.4 |

| Ag | % | 50.4 | 45 | 48.3 | 48.3 | 49.3 | 55.5 | 56.8 | – | – | – | – | 50.2 |

| Pyrite Concentrate | |||||||||||||

| Au | % | 24.7 | 27.4 | 27 | 26.3 | 25.6 | 23.5 | 20.9 | – | – | – | – | 25.5 |

| Total Production | |||||||||||||

| Total Au | Koz. | 159 | 165 | 147 | 127 | 117 | 128 | 74 | – | – | – | – | 916 |

| Total Cu2 | Mlbs. | 36 | 26 | 28 | 25 | 24 | 26 | 17 | – | – | – | – | 182 |

| Total Ag3 | Koz. | 290 | 253 | 296 | 222 | 216 | 258 | 238 | – | – | – | – | 1,772 |

| Total GEO5 | Koz. | 225 | 214 | 205 | 179 | 167 | 183 | 111 | – | – | – | – | 1,283 |

- Totals in the table above do not include 2025 production and therefore do not correspond to the Mineral Reserve estimate, which reflects from May 31, 2025, onward.

- Total copper production reflects copper recovered from copper concentrate only. Copper recovered from pyrite concentrate is not payable.

- Total silver production reflects silver recovered from copper concentrate only. Silver recovered from pyrite concentrate is not payable.

- For the gold equivalent calculation and metal price assumptions for the current LOM plan, refer to the “Gold Equivalent Calculations” section on page 9 of this news release.

- For the gold equivalent calculation and metal price assumptions for the previous LOM plan, refer to the “Gold Equivalent Calculations” section on page 9 of this news release.

Figure 2. Long section of the Chelopech mine, looking northwest, showing mine development and silica envelope outlines. The current stope designs (green) are shown overlain, compared to those used in the previous mine plan (red).

Further value potential from in-mine and brownfield exploration

Further value potential from in-mine and brownfield exploration

The updated LOM demonstrates the potential to increase Chelopech’s mine life through a combination of on-going optimization of the existing MRMR in conjunction with exploration and development of new mineral resources.

In November 2025, DPM announced the discovery of new high-grade mineralization at the WZD target, located within the northern flank of the Chelopech mine concession and approximately 300 metres below existing Mineral Reserves and current mine infrastructure. Initial drilling results from this discovery, made in a relatively under-explored area of the mine concession, demonstrate that the WZD target is highly prospective for additional discoveries.

Given the significance of the WZD target, DPM has planned an additional 10,000 metres of drilling, which is expected to be completed within the first quarter of 2026. DPM intends to provide an update on results from drilling in the second quarter of 2026.

DPM has also been focused on advancing the Chelopech North and Brevene licences to mining concessions. The Company expects the Chelopech North concession in 2026, which is an area of 4.6 square kilometers surrounding the Chelopech mine concession. Concurrently, the Brevene exploration licence is in the process of being converted to a Commercial Discovery, which is the next phase of work towards converting the licence to a mining concession under the Bulgarian permitting process. The Brevene licence includes approximately 27.3 square kilometres and contains several prospective exploration targets.

Further to the exploration potential, the Mineral Resource continues to exhibit meaningful upside potential under lower cut-off value assumptions, which is increasingly relevant in the context of the current higher metal price environment.

A grade tonnage sensitivity analysis is shown below, which highlights the potential additional mineralization that is currently below the current cut-off. With stronger metal prices supporting lower economic cut-off values, the Company will focus on opportunities to convert additional material into the mine plan, supporting potential LOM extension and enhanced long-term optionality, subject to ongoing technical and economic evaluation, including maintaining or improving margins.

| Chelopech Mineral Resource Grade / Tonnage Sensitivity (Reported exclusive of Mineral Reserves, as of May 31, 2025) |

||||||||

| Resource Category |

Profit Indicator | Tonnes | Grade Values | Contained Metal | ||||

| ($/t) | (Mt) | Au (g/t) |

Ag (g/t) |

Cu (%) |

Au (Moz.) | Ag (Moz.) | Cu (Mlbs.) | |

| Measured & Indicated Resource |

> -10 | 26.7 | 1.63 | 7.06 | 0.47 | 1.4 | 6.1 | 276 |

| > -5 | 19.6 | 1.91 | 8.17 | 0.56 | 1.2 | 5.1 | 242 | |

| > 0 | 15.3 | 2.18 | 9.19 | 0.64 | 1.1 | 4.5 | 216 | |

| > 5 | 12.9 | 2.41 | 10.02 | 0.72 | 1.0 | 4.2 | 205 | |

| > 10 | 11.4 | 2.58 | 10.56 | 0.77 | 0.9 | 3.9 | 194 | |

- The current Mineral Resource estimate base case is shown highlighted in grey.

- The Mineral Resource is reported exclusive of Mineral Reserves.

- Profit indicator ($/t) = NSR ($/t) – royalty ($/t) – sustaining capital ($/t) – variable operating cost ($/t).

Technical Information

The Mineral Resource and Mineral Reserve estimate for the Chelopech mine and other scientific and technical information which supports this news release was prepared by DPM with review and guidance at various stages provided by Environmental Resources Management (“ERM”). The Qualified Persons (“QP”) are satisfied as to the appropriateness and quality of the technical work completed and accept responsibility for the disclosure, in accordance with Canadian regulatory requirements set out in National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The QP for the Mineral Resource estimate is Malcolm Titley, BSc, MAIG, Associate Principal Consultant, ERM, and the QP for the Mineral Reserve estimate is Nick MacNulty, Principal Mining Engineer for ERM Consultants. Both Malcolm Titley and Nick MacNulty are Qualified Persons as defined under NI 43-101 and are independent of the Company.

Ross Overall, Corporate Mineral Resource Manager, of the Company, who is a QP, as defined under NI 43-101, has reviewed and approved the contents of this news release.

A technical report prepared in accordance with NI 43-101 for Chelopech will be filed with 45 days of this news release under the Company’s profile on SEDAR+. Readers are encouraged to read the technical report in its entirety, including all qualifications, assumptions, exclusions and risks that relate to the MRMR estimate and LOM plan.

Gold Equivalent Calculations

Total produced GEOs reflects total metal recovered from copper and pyrite concentrate, presented on an equivalent basis. The Company uses conversion ratios for calculating GEO for its silver and copper production, which are calculated by multiplying the volumes of silver and copper produced by the respective assumed metal prices, and dividing the resulting figure by assumed gold price.

The GEO calculation for the current mine plan is based on the following metal prices:

- Gold: $3,200/oz. for 2026, $3,000/oz. next two years, $2,750/oz. for 2029 and beyond.

- Copper: $4.25/lb. for 2026, $4.50/lb. for 2027, $4.85/lb. for 2028, $4.90/lb. for 2029 and beyond.

- Silver: $37.00/oz. for 2026, $35.00/oz. for 2027, $36.50/oz. for 2028, $34.40/oz. for 2029 and beyond.

For the previous mine plan, total produced GEOs reflects total metal recovered to copper and pyrite concentrate, presented on an equivalent basis. This is based on the following metal price assumptions:

- Gold: $2,300/oz. gold for the first two years, $2,100/oz. gold for 2028 and beyond.

- Copper: $4.00/lb. copper for the first two years, $4.15/lb. copper for 2028 and beyond.

- Silver: $29.00/oz. silver for the first two years, $26.50/oz. for 2028 and beyond.

About DPM Metals Inc.

DPM Metals Inc. is a Canadian-based international gold mining company with operations and projects located in Bulgaria, Bosnia and Herzegovina, Serbia and Ecuador. Our strategic objective is to become a mid-tier precious metals company, which is based on sustainable, responsible and efficient gold production from our portfolio, the development of quality assets, and maintaining a strong financial position to support growth in mineral reserves and production through disciplined strategic transactions. This strategy creates a platform for robust growth to deliver above-average returns for our shareholders. DPM trades on the Toronto Stock Exchange (symbol: DPM) and the Australian Securities Exchange as a Foreign Exempt Listing (symbol: DPM).

For further information please contact:

Jennifer Cameron

Director, Investor Relations

Tel: (416) 219-6177

[email protected]

Cautionary Note Regarding Forward-Looking Statements

This news release contains “forward looking statements” or “forward looking information” (collectively, “Forward Looking Statements”) that involve a number of risks and uncertainties. Forward Looking Statements are statements that are not historical facts and are generally, but not always, identified by the use of forward looking terminology such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “outlook”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or that state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms or similar expressions. The Forward Looking Statements in this news release relate to, among other things, the Company’s strategic objective and associated returns to shareholders, including DPM’s strategy to become a mid-tier precious metals company; the estimation of Mineral Reserves and Mineral Resources and the realization of such mineral estimates; mine life; the LOM plan; production, processing and recoveries forecasts; expected financial, cost and other metrics; success of exploration activities, the price of gold, copper, and silver, and other commodities; and proposed optimization activities and proposed exploration activities. Forward Looking Statements are based on certain key assumptions and the opinions and estimates of management and the QPs, as of the date such statements are made, and they involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any other future results, performance or achievements expressed or implied by the Forward Looking Statements. In addition to factors already discussed in this news release, such factors include, among others, fluctuations in metal prices and foreign exchange rates; risks arising from the current economic environment and the impact on operating costs and other financial metrics, including risks of recession; the speculative nature of mineral exploration, development and production, including changes in mineral production performance, exploitation and exploration results; changes in tax, tariff, and royalty regimes in the jurisdictions in which the Company operates, sells it concentrates. or which are otherwise applicable to the Company’s business, operations, or financial condition; possible inaccurate estimates relating to future production, operating costs and other costs for operations; possible variations in ore grade and recovery rates; inherent uncertainties in respect of conclusions of economic evaluations, economic studies and mine plans; the Company’s dependence on continually developing, replacing and expanding its mineral reserves; the ability of the Company to extend the Chelopech mine life; risks related to the possibility that future exploration results will not be consistent with the Company’s expectations, that quantities or grades of reserves will be diminished, and that resources may not be converted to reserves; risks related to the financial results of operations, changes in interest rates, and the Company’s ability to finance its operations; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; uncertainties inherent with conducting business in foreign jurisdictions where corruption, civil unrest, political instability and uncertainties with the rule of law may impact the Company’s activities; the effects of international economic and trade sanctions; accidents, labour disputes and other risks inherent to the mining industry; failure to achieve certain cost savings; risks related to the Company’s ability to manage environmental and social matters, including risks and obligations related to closure of the Company’s mining properties; risks related to climate change, including extreme weather events, resource shortages, emerging policies and increased regulations relating to related to greenhouse gas emission levels, energy efficiency and reporting of risks; the commencement, continuation or escalation of geopolitical crises and armed conflicts and their direct and indirect effects on the operations of DPM; opposition by social and non-governmental organizations to mining projects; uncertainties with respect to realizing the anticipated benefits from the development of the Company’s exploration and development projects; cyber-attacks and other cybersecurity risks; competition in the mining industry; claims or litigation; limitations on insurance coverage; changes in laws and regulations applicable to the Company and its business and operations; the Company’s ability to successfully obtain all necessary permits and other approvals required to conduct its operations; employee relations, including unionized and non-union employees, and the Company’s ability to retain key personnel and attract other highly skilled employees; unanticipated title disputes; volatility in the price of the common shares of the Company; potential dilution to the common shares of the Company; damage to the Company’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the Company’s handling of environmental matters or dealings with community groups, whether true or not; risks related to holding assets in foreign jurisdictions; as well as those risk factors discussed or referred to in any other documents (including without limitation the Chelopech Technical Report and the Company’s most recent Annual Information Form) filed from time to time with the securities regulatory authorities in all provinces and territories of Canada and available on SEDAR+ at www.sedarplus.ca. The reader has been cautioned that the foregoing list is not exhaustive of all factors which may have been used. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in Forward Looking Statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that Forward Looking Statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company’s Forward-Looking Statements reflect current expectations regarding future events and speak only as of the date hereof. Unless required by securities laws, the Company undertakes no obligation to update Forward Looking Statements if circumstances or management’s estimates or opinions should change. Accordingly, readers are cautioned not to place undue reliance on Forward Looking Statements.

____________________

1 Based on life of mine production of 1.2 million ounces of gold, 2.4 million ounces of silver and 231 million pounds of copper. Refer to the “Gold Equivalent Calculations” section on page 9 of this news release and the Current Life of Mine Plan table on page 5.

2 Based on life of mine production of 1.2 million ounces of gold, 2.4 million ounces of silver and 231 million pounds of copper. Refer to the “Gold Equivalent Calculations” section on page 9 of this news release and the Current Life of Mine Plan table on page 5.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/51c52a14-f486-4c1e-8345-be8d54ff6f42

https://www.globenewswire.com/NewsRoom/AttachmentNg/6e3bf92b-11a5-4162-aa63-e4451ced7660