HONG KONG, Dec. 22, 2025 (GLOBE NEWSWIRE) — CoinEx‘s 2025 annual report highlights a profound structural shift in the cryptocurrency market. The traditional “4-Year Halving Cycle” is disintegrating under institutional pressure. Spot Bitcoin ETFs have turned BTC into a standard portfolio asset, transforming it from a speculative play into a macro reserve-grade instrument.

The report examines the transition from retail speculation to an institution-driven ecosystem and answers six key questions for the 2026 portfolio strategy.

CoinEx’s base case forecasts Bitcoin reaching $180,000 by 2026, but warns that the era of broad altcoin rallies is over. Liquidity will favor only proven “Blue-Chip Survivors” with real adoption. Retail investors must adopt a Double-Track Strategy: anchor in BTC, ETH, and compliant yields to piggyback institutions, while seeking alpha in niche on-chain sectors too small for large capital.

DeFi has entered a profit-focused phase, prioritizing Fee Switch Protocols that distribute revenue like equity. In AI x Crypto, sustainable advantage lies in using tools rather than buying tokens—empowering retail as “Super-Individuals” through AI agents and “Vibe Coding.”

The 2026 market will reward cash flow certainty, structural adoption, and technological leverage over volatility bets.

1. Markets: What will the overall crypto market look like?

The 4-year cycle is structurally breaking down

The once-reliable 4-year halving cycle is fracturing. Past cycles featured retail-driven euphoria post-halving, leading to parabolic rises and deep corrections. In contrast, 2025 saw Bitcoin peak near $125,000 in October before falling below $90,000 without excessive speculation. Early profit-taking and subdued sentiment suggest halvings are losing potency as supply shocks diminish against growing demand.

Institutional absorption drives this change. Spot Bitcoin ETFs exceeded $150 billion AUM by late 2025, attracting capital from corporates, governments, endowments, pensions, and sovereign funds. Bitcoin now behaves more like an emerging reserve asset than a bubble.

Global liquidity remains key, albeit with a shallow impact

Global liquidity will offer modest support in 2026, constrained by divergent central bank paths. Markets expect 50-75 bps Fed cuts, while ECB and PBOC stay cautious and BoJ normalizes. Bitcoin’s correlation with M2 has weakened since 2024 ETFs. Liquidity provides a base, but institutional flows—bolstered by regulatory progress—will drive gains.

Another ATH in 2026 but altcoin season is not coming

CoinEx is bullish, projecting Bitcoin at $180,000 by 2026 on policy tailwinds and institutional demand. Drawdowns of 20-30% are likely from macro or geopolitical risks, but a classic 70-80% crash is improbable. A 2x move from current levels remains the base case.

Broad altcoin gains, however, are unlikely. No traditional altseason is expected. Retail exhaustion and fragmented liquidity have shortened project lifecycles. Capital will selectively reward blue-chip projects with proven adoption, recurring revenue, and profitability.

2. Institution vs. Retail: Where is the room for retail investors?

Retail remains relevant, but excess-return opportunities are narrowing as institutions dominate. Easy alpha from narratives and emotion is fading. Success now depends on structural understanding and rigorous research.

Beta strategy: Anchoring in anti-inflation reserves and compliant yields

Bitcoin and Ethereum are maturing into anti-inflationary stores of value. Retail should anchor portfolios here rather than chase extreme multiples. Piggybacking institutions via compliant yield products—such as Staking ETFs and insured wrappers—is prudent. Regulatory easing favors these low-volatility, on-chain yield vehicles.

Real-World Assets (RWAs) are establishing a programmable risk-free rate through tokenized Treasuries. Selection criteria should prioritize compliance, ecosystem strength, developer retention, and revenue generation over price speculation.

Alpha strategy: From sentiment chasing to on-chain precision

2025’s $19 billion October liquidation ended reflexive retail tops. High-FDV launches and VC overhang created valuation traps. Engineered pumps became expensive without retail buyers.

For 2026, retail alpha requires a Double-Track Strategy: avoid high-FDV unlock-heavy assets; favor fair launches with organic demand. Focus on Product-Market Fit, audited revenue, and execution.

Shift from CEX sentiment to on-chain analytics using tools like Nansen, Glassnode, Santiment, and Dune. Retail’s agility enables faster rotations and smart-money tracking.

Alpha lies in institutional blind spots: Web3 payments, vertical AppChains (gaming, creators), and new-chain liquidity voids—too small for billion-dollar deployments but ideal for retail scale.

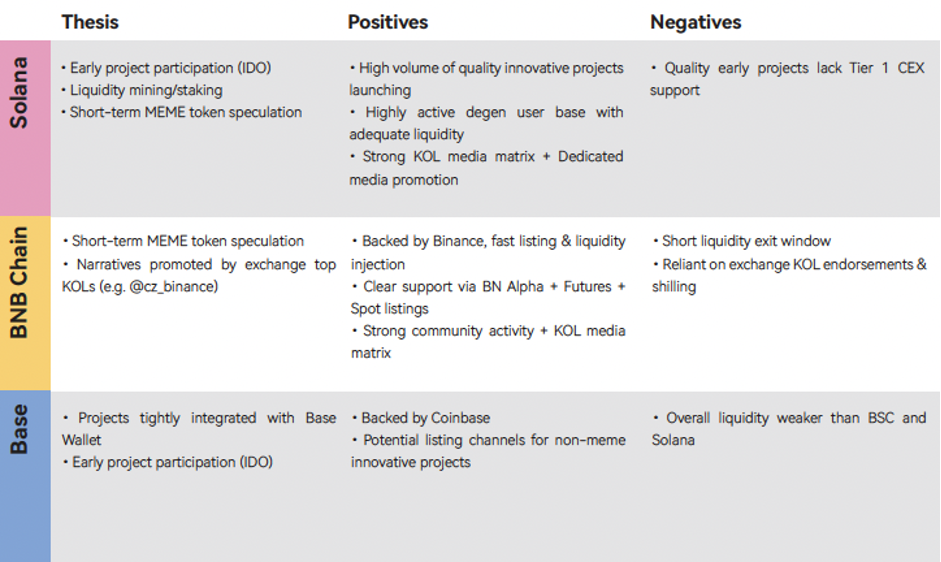

3. Public Blockchains: What is the retail playbook for public blockchains?

Regulated institutional inflows have made top Layer 1s institution territory. Yet high-convexity opportunities persist in volatile niches: memes, AI, privacy, staking, and mining. These remain structurally open to retail embracing risk.

Competitive rankings are stable. Solana, BSC, and Base will lead in liquidity, developer density, and speed—optimal for retail engagement.

Retail participation playbooks

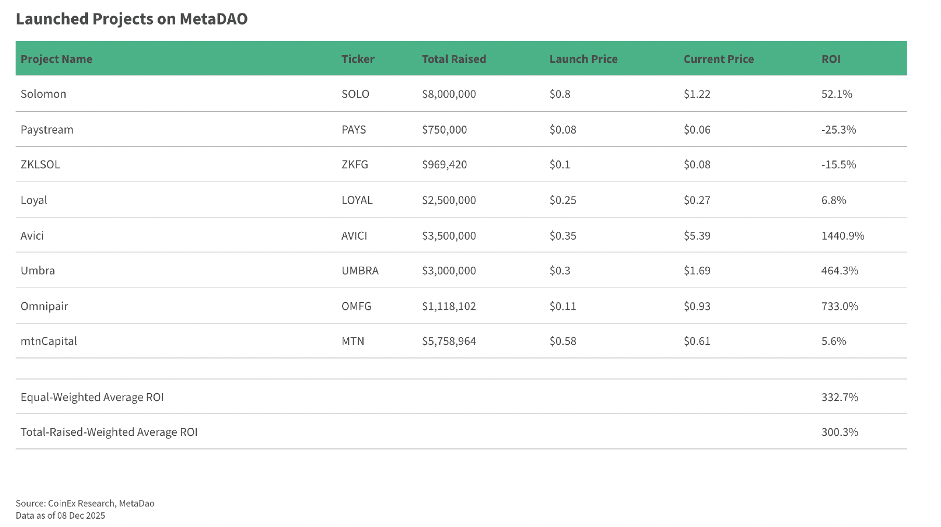

Early-stage access: ICO / IDO / Launchpads

Token sales offer low-barrier alpha. Resource-constrained retail should select reputable launchpads for curated, risk-managed exposure.

Meme tokens

Community-driven assets deliver high-risk, high-reward momentum via virality and listings—suited for volatility-tolerant retail.

On-chain staking yield

Staking and liquidity mining provide controlled yields, expected to exceed TradFi rates in 2026 within audited ecosystems. This complements beta strategies using institutional-built infrastructure.

4. TradFi x Crypto: What is the next frontier for TradFi x Crypto?

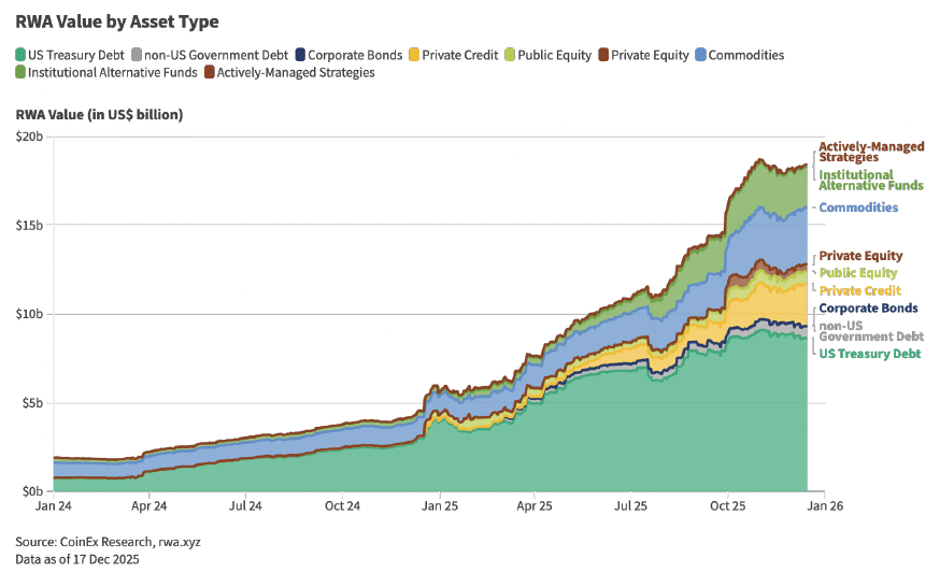

The nonlinear evolution: From native issuance to tokenization to perpetualization

Tokenization leads the convergence, surpassing $18 billion—mostly Treasuries—with stocks at $670 million. Expansion into private credit, equity, and alternatives is imminent, led by funds like BlackRock’s BUIDL.

The next step is perpetualization: leveraged perps on tokenized equities and RWAs, enhanced by AI risk engines for auto-deleveraging.

Deeper integration includes native on-chain issuance of equities and fixed income, making settlement and collateral programmable.

The yield-seeking behavior is shifting

Institutional-grade yields are democratizing. Protocols like Plume offer 4-10% real yields from off-chain assets, wrapped for DeFi composability and compounding.

CEXs will compete aggressively for AUM via subsidized earn products and TradFi-style structured instruments blended with DeFi flexibility.

5. DeFi: Which DeFi sectors deserve our attention?

DeFi has matured beyond experimentation into a profit-driven phase. Capital consolidates around genuine PMF and sticky cash flows.

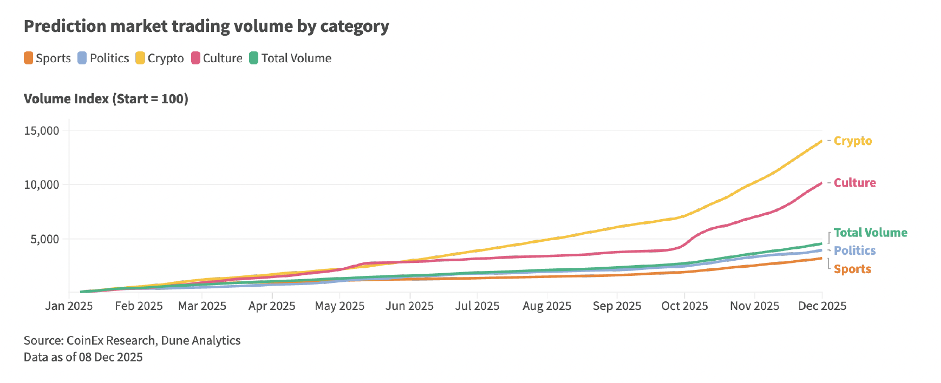

Emerging sectors: High-growth PMF

Prediction markets and real-time data infrastructure

2025 volumes topped $3 billion weekly, with crypto events growing fastest due to liquidation-free, leveraged binary outcomes. 2026 will see hybrid hedging products combining prediction markets with traditional derivatives.

Intent-based architectures: The “solver” revolution

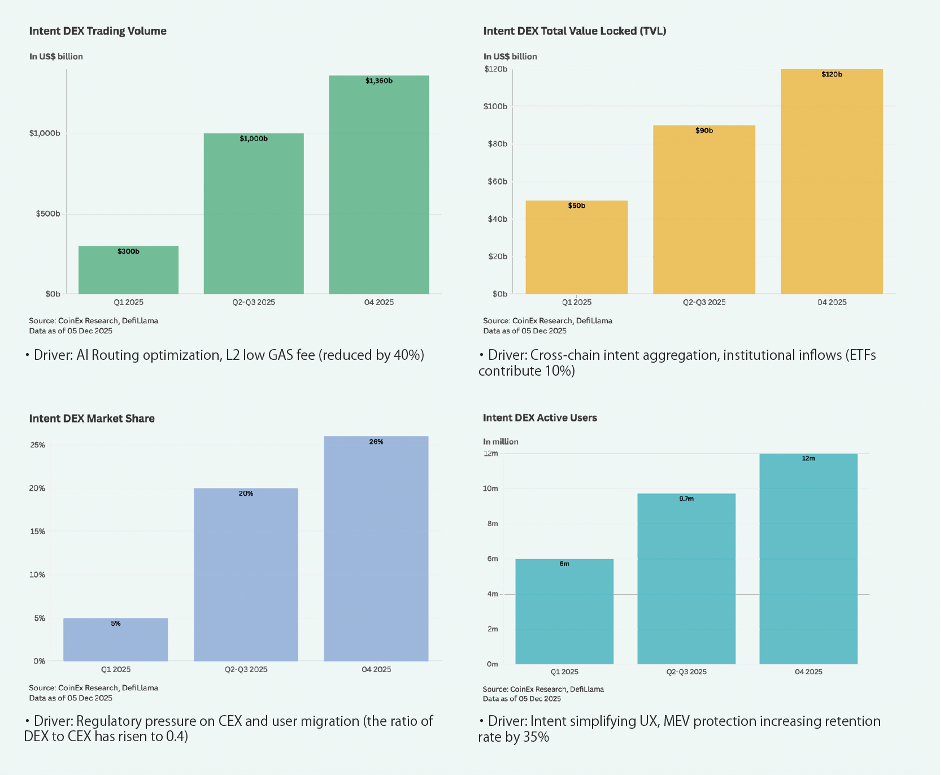

Intent DEXs grew 138% to $1.2 trillion via Uniswap X and CoW Swap. Users express intent; AI solvers optimize execution and neutralize MEV. Future platforms will manage yield, privacy, and RWA perps, rivaling CEX volumes. Competition shifts to algorithmic efficiency.

Protocols with real value accrual: The core investment universe

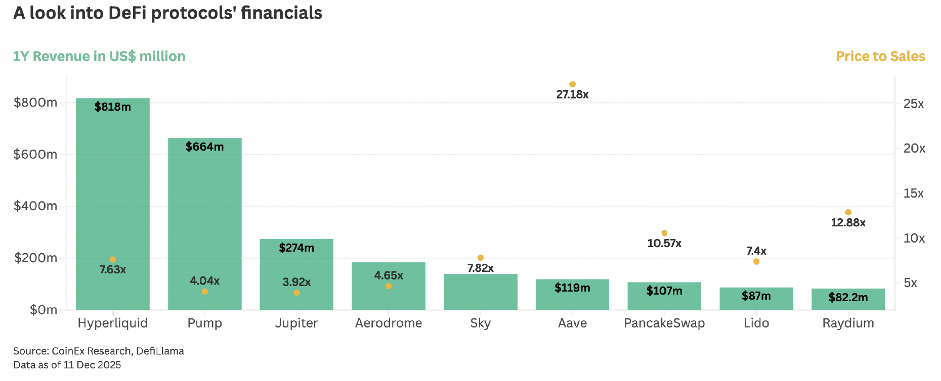

Focus on “Fee Switch” protocols where revenue exceeds emissions:

- Perpetual derivatives: Hyperliquid (~$1B annualized revenue, cheap valuation).

- Aggregators: Jupiter (50% fee buybacks, Solana super app).

- Foundational DEXs: Raydium (meme economy tax), Aerodrome (sustainable model), PancakeSwap (deflationary yield).

- Others: Pump.fun (launch monetization), SKY (RWA banking), Aave (lending revenue to holders), Lido (Ethereum staking upside).

Avoid governance tokens without cash-flow claims. Prioritize infrastructure at modest revenue multiples controlling interfaces or liquidity.

6. AI x Crypto: Shall we buy AI tokens or use the tools?

The sector faces a fork: speculate on wrapper tokens or deploy tools. Maturity favors the “Machine Economy” run by autonomous agents.

The New market environment: Infrastructure for the machine economy

Protocols like x402 enable sub-$0.0001, 200ms agent payments. Web3 powers physical AI (robotics) and decentralized compute, breaking Big Tech monopolies.

Manual trading lags machine speed. Retail must adopt agentic infrastructure.

The strategic pivot: From “Concept speculation” to “Productivity alpha”

Distinguish true PMF (verifiable inference, agent payments, decentralized GPUs) from marketing hype.

Build AI-enhanced systems:

- Research: Agents aggregate on-chain and sentiment data.

- Decision: LLMs filter noise.

- Execution: Automated arbitrage, DCA, risk management.

Ultimate edge: “Vibe Coding”—using LLMs and low-code tools to create custom agents from plain-English strategies. This elevates retail to “Super-Individual” status, competing at machine velocity.

In 2026, value accrues to the utility. Arm yourself with tools to master the market rather than be mastered by it.

Disclaimer: This content is for informational purposes only and not investment advice. Information may not be complete or accurate. Do your own research; the authors accept no liability for losses.

About CoinEx

Established in 2017, CoinEx is an award-winning cryptocurrency exchange designed with users in mind. Since its launch by the industry-leading mining pool ViaBTC, the platform has been one of the earliest crypto exchanges to release proof-of-reserves to protect 100% of user assets. CoinEx provides over 1400 coins, supported by professional-grade features and services, for its 10+ million users across 200+ countries and regions. CoinEx is also home to its native token, CET, incentivizing user activities while empowering its ecosystem.

To learn more about CoinEx, visit: Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube

Contact:

CoinEx

[email protected]

Disclaimer: This content is provided by CoinEx. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility. Globenewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/6cdddffb-1259-4809-8d84-5ef868822bc1

https://www.globenewswire.com/NewsRoom/AttachmentNg/9944b0db-963c-477d-ab98-bec13cb6891a

https://www.globenewswire.com/NewsRoom/AttachmentNg/57b52986-f2d9-4c5e-949c-6dc1c7a01afd

https://www.globenewswire.com/NewsRoom/AttachmentNg/57f9eec6-b79e-4926-a4a6-6c91ad358f2d

https://www.globenewswire.com/NewsRoom/AttachmentNg/2d127564-61e7-48d7-bb44-65a8077cbc7a

https://www.globenewswire.com/NewsRoom/AttachmentNg/84f45569-032a-4968-950f-994aa0f1584f

https://www.globenewswire.com/NewsRoom/AttachmentNg/a3b1936f-30f0-4040-a47b-5e19d2e6cb26

https://www.globenewswire.com/NewsRoom/AttachmentNg/cc7e0a9e-30fa-4027-9678-528973137cab