Nominates Four Director Candidates with Expertise, Independence and Accountability Required to Unlock Shareholder Value

Believes Proposed Initiatives Could Result in Share Price Upside of at Least 50%

DARIEN, Conn., March 20, 2025 (GLOBE NEWSWIRE) — Carronade Capital Management, LP (together with its affiliates, “Carronade Capital”, “our” or “we”), which beneficially owns approximately 2.9 million shares of Common Stock of Cannae Holdings, Inc. (NYSE: CNNE) (“Cannae” or the “Company”) and is one of the Company’s top five shareholders, today announced it has issued the below letter to Cannae’s Board of Directors (the “Board”) and nominated four independent director candidates for the four Board seats up for election at the Company’s 2025 Annual Meeting of Shareholders.

Carronade Capital believes Cannae’s total shareholder return and corporate governance can be meaningfully improved, and significant opportunities exist to unlock substantial value for all shareholders. We believe Cannae can halt persistent underperformance and restore shareholder confidence by improving capital allocation and unlocking portfolio value through spin outs or buybacks, reducing overhead costs and aligning management incentives, and establishing corporate governance and accountability. If decisive action is taken, we believe that Cannae equity could have a share price upside of at least 50% as a result of activities initiated by year end.

Carronade’s four highly qualified nominees are as follows:

Mona Aboelnaga

- 35 years of experience including at Siguler Guff & Company and Proctor Investment Managers with expertise in investment management and private equity industries.

- Extensive corporate governance expertise as a board member of both public and private companies including Webster Financial, a financial services company, Perpetual Limited, an Australian-based diversified global financial services company, and Sterling Bancorp, a regional financial services company.

Benjamin Duster

- 45 years of experience including at Wells Fargo and Salomon Brothers with expertise in working with companies to improve execution effectiveness and create long-term sustainable value.

- Extensive public and private company board service including Expand Energy, an oil and gas production company, Weatherford International, a global energy services company, Republic First Bancorp, a commercial bank, and Alaska Communications Systems, a broadband and telecommunications service provider.

Dennis Prieto

- 21 years of experience including at Aurelius Capital Management and Evercore with expertise in financial analysis and restructuring oversight.

- Significant investment management and board experience including GO Lab, a privately held building products company, Aventiv Technologies, a provider of telecommunications and technology solutions, Mohawk Gaming Enterprises, a gaming company, and Endo International GUC Trust, a trust established to obtain recoveries for creditors of Endo International plc.

Cherie Schaible

- 24 years of experience including as General Counsel of Ankura Consulting Group and Associate General Counsel of AIG Investments with expertise in complex legal and financial matters.

- Extensive experience in structuring, negotiating and leading a variety of corporate legal matters in public and private companies.

The full text of the letter is below:

March 20, 2025

Cannae Holdings, Inc.

1701 Village Center Circle

Las Vegas, Nevada 89134

Attn: Board of Directors

Dear Members of the Board of Directors,

Entities managed by Carronade Capital Management, LP (together with its affiliates, “Carronade Capital” or “We” or “Us” or “Our”) beneficially own approximately 2.9 million shares of Common Stock of Cannae Holdings, Inc. (“Cannae” or the “Company” or “You” or “Your”), making us one of your top five investors. We believe Cannae’s total shareholder return (“TSR”) and corporate governance can be meaningfully improved, and significant opportunities exist within the control of both management and the Board of Directors (the “Board”) to unlock substantial value for all shareholders. We are reiterating these previously communicated views to you, and the broader market, to ensure the entire Board is made aware of our discussions to date and to highlight this potential value creation opportunity in the hope of building a consensus for the best path forward.

Our letter today outlines why we believe the status quo at Cannae is untenable and why dramatic change is required to halt persistent underperformance and egregious governance practices for the benefit of all stakeholders. We believe there are numerous ways to drive value creation, and, by extension, shareholder returns, including by reducing costs and aligning incentives, improving capital allocation, unlocking the value of the parts of the portfolio, and establishing corporate governance and accountability by reconstituting the Board with truly independent directors. If Cannae takes decisive action to properly implement these achievable steps and rebuild investor confidence, we believe that the equity could have share price upside of at least 50% as a result of activities initiated by year-end.

The Status Quo is Untenable

In our view, there is an urgent need for changes in strategy and governance based on Cannae’s substantial long-term relative TSR underperformance, persistent discount to intrinsic value, shareholder frustration with corporate strategy, and a pattern of governance deficiencies that we believe have significantly hindered the Company’s ability to create shareholder value. Our concerns are underscored by the high degree of interconnectedness amongst the current directors and Cannae’s classified Board structure which, among other governance concerns, have resulted in repeated adverse voting recommendations from leading proxy advisory firms. We were further shocked by the Board’s egregious actions earlier this week, while we were engaged in active settlement discussions, to accelerate equity vesting for directors if they fail to be re-elected by shareholders and to require the repurchase of half of CEO and Chairman Bill Foley’s shares at a significant premium to market prices. This is on top of his already rich compensation package if he invokes his right to resign because a single director is elected without his consent. That a Board of Directors deemed these actions consistent with their fiduciary duties and in the best interest of shareholders demonstrates a complete lack of independence and an abdication of their duty. We believe such an offensive combination of entrenchment techniques and unfair enrichment are beyond the pale and make it crystal clear that immediate change is necessary in the boardroom.

Management’s stated strategy consists of “improving the performance and valuation of our portfolio companies, making new investments primarily in private companies that will grow NAV, and returning capital to shareholders.”1 Put plainly, management’s plan is not working. Cannae has a valuable collection of assets, but buybacks to date have failed to close the discount due to market concerns around overall strategy and perceived misalignment of interests between management and shareholders. Shareholders have consistently shared concerns that they do not want Cannae to sell public shares to invest in small private positions with no disclosure – such actions we believe would only compound the current problems and Cannae’s persistent value discount. Despite a handful of successful investments in the past, the current portfolio of private investments is consistently marked at cost and the remaining investments in public equities have destroyed approximately $900 million of value.2 Market feedback that we have gathered to date suggests a near unanimous view that numerous shareholders prefer a return of their capital as opposed to management’s stated goal of selling down public positions to invest more in private equity.

| “Since Ceridian, they have made a bunch of bad capital allocation decisions…We would rather them distribute value than re-invest. They haven’t earned the right to keep that capital.” |

| – Top 10 Shareholder, Nov. 2024 |

Furthermore, a lack of strategic cohesion amongst investments and limited portfolio company disclosure weigh on investor confidence. There has been no clear investment narrative for shareholders to rally behind, as we consistently hear Cannae described simply as the Bill Foley co-investment vehicle. Additionally, we believe the persistent marking of private investments at cost without balance sheet information and absence of third-party valuations, or enough disclosure for investors to determine performance, are significant contributors to the wide NAV discount. As one analyst queried on the Company’s third quarter 2024 earnings call:

| “If you had your wish how many positions would you have? How large would they be and I just think I kind of look at some of the parts… It’s just kind of all over the place you have things that are worth less than $1 per share and I just don’t see the focus here.” |

| – Oppenheimer Q&A on Q3 2024 Earnings Call |

As a result of these perceptions in the market, Cannae trades at a much steeper discount to NAV than its disclosed proxy peers and closed end fund peers. The discount widened persistently after the IPO of Dun & Bradstreet in 2019 and the sell down of Dayforce from 2020 through 2023, implying the market lacks confidence in the current leadership’s ability to execute a viable strategy for value creation going forward. Over the past three years, Cannae equity has traded at an average discount to its NAV per share of -40%, which places it in the bottom tenth of US investment firms with assets over $500 million.3 Approximately 90% of Cannae’s market cap is covered by public holdings net of debt, and the market is valuing the remaining nearly $900 million of private NAV at an 85% discount. A well-managed company with a strong asset base should not be trading at such a deep discount. We believe this misalignment points to a failure in capital allocation, strategic planning, and governance oversight.

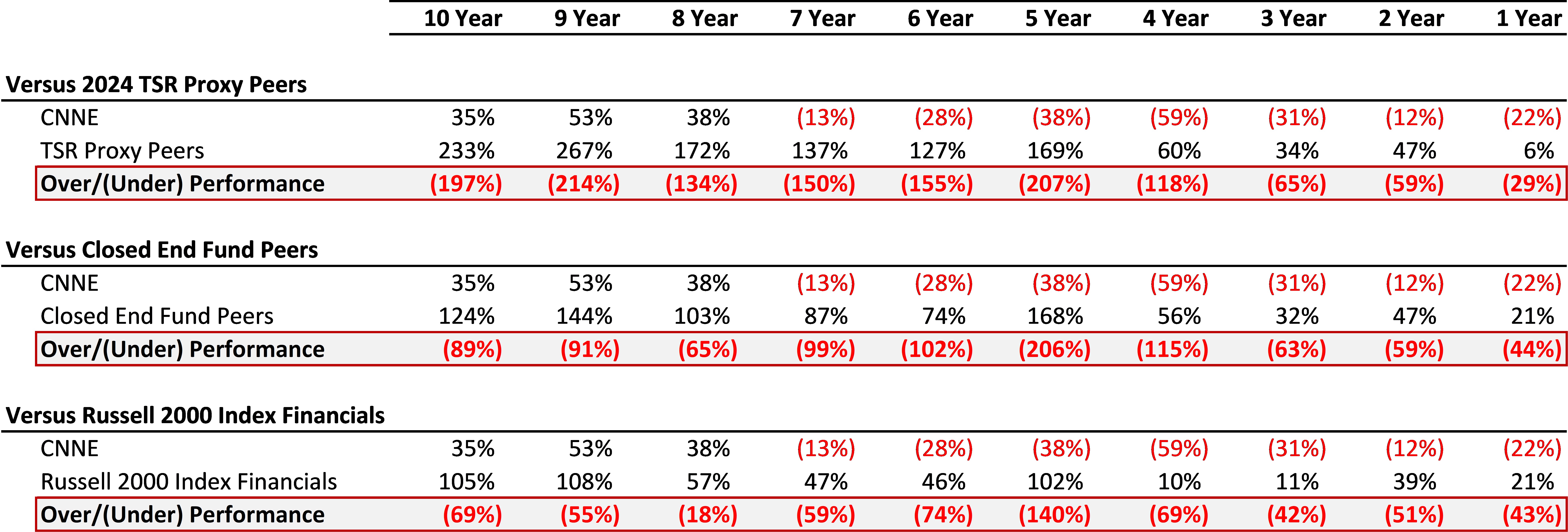

Shareholders ‘vote with their feet’, and the most objective indication that fundamental change is required is relative TSR underperformance compared to peers over the long term. Even when viewed on an absolute basis, Cannae shareholders have suffered a negative total return since Cannae became an independent public company despite the backdrop of one of the strongest bull markets in history. Despite the readily identifiable value in the Company’s portfolio, Cannae’s stock has significantly underperformed most relevant benchmarks.4 Consistent underperformance is the market telling Cannae, “The status quo is unacceptable.”

Dramatic Change is Required Immediately

As discussed previously with Mr. Foley and Mr. Caswell, we believe Cannae can resolve these issues through decisive action in the near term. We believe that Cannae must pursue the following initiatives without delay:

- Reduce overhead costs and align management incentives – A history of burdensome fees and non-performance linked compensation paid out to management are out of step with the overall performance of Cannae’s portfolio, are impacting the discount which the market places on the NAV, and need to be streamlined to reflect best-in-class approach. We believe the Company should implement a corporate overhead cost reduction program and convert the termination fee payable to its manager, Trasimene Capital Management, into performance-based, vesting stock compensation.

- Improve capital allocation, unlock portfolio value, and provide a clear investment narrative – Management’s current strategy is vague and undifferentiated, and shareholder feedback is that management has lost its mandate from shareholders to allocate capital in this way. We believe a commitment from management and the Board to return shareholder capital tied up in Dun & Bradstreet, Alight and Paysafe shares either via spin outs or substantial buybacks would force a collapse of the discount placed on those assets and result in a re-rating of the remaining portfolio. We appreciate that management has conceded in its last earnings call that a significant return of capital is a priority; however, we believe that Cannae should commit definitively to returning a substantial majority of this capital on an accelerated timeline. Management could then reallocate its time from monitoring small stakes in large public companies where their ability to “improve the performance and valuation” is limited to focusing on improving disclosure and valuation of the remaining private assets.

- Establish governance oversight – We believe that market confidence in this new plan would be best supported by new fit-for-purpose directors that will be a voice for shareholders on the Board. To that end, we delivered a formal notice in December nominating a slate of four highly qualified and independent director candidates for election to the Board at the Company’s 2025 Annual Meeting of Stockholders (the “Annual Meeting”). In addition to the four new directors, we believe the Board should refresh leadership of the Affiliate Transaction Committee and the Nomination and Governance Committee chosen from the four new candidates, and the Board should also create a new committee for Value Maximization tasked with the formulation and oversight of successful execution of a plan designed to improve shareholder returns. The need for immediate and significant governance reform is underscored by Cannae’s entrenchment and unfair enrichment actions earlier this week.

Our intent at the time of nomination was, and continues to be, to engage constructively with the Board with the goal of reaching a consensual solution for the benefit of all stakeholders. However, it appears that the current Board fails to recognize the urgency of the situation. We are therefore prepared to take all necessary steps to ensure that shareholders have the opportunity to vote for directors who they believe have the skill sets and experience necessary to drive value creation and ensure accountability in the boardroom.

Management’s Lack of Willingness to Meaningfully Engage

We have sought to engage with management and the Board for several months to convey our views with respect to corporate strategy and governance with the aim of closing the NAV discount and improving relative share price performance. As discussed in our original private letter to the Board dated December 19, 2024, we submitted our nomination notice as required under the Company’s Bylaws despite the nomination deadline of December 27, 2024, nearly six months ahead of the anticipated Annual Meeting date. We did so in order to preserve our rights as shareholders to elect directors at the Annual Meeting, but with the hope that it would serve as a starting point for further positive discussions. Unfortunately, we now believe our sincere efforts to engage constructively have not been meaningfully reciprocated in good faith.

While the Company confirmed receipt of our December letter and nomination notice, it was more than thirty days before we received any further communication. Given the Company’s significant governance failings and chronic underperformance, we have offered to travel to meet in-person with relevant Board members, but Cannae has yet to permit us to speak with any non-management directors. Perhaps as a result, the Board has failed to appreciate the market’s call for urgent, meaningful governance changes. Then on March 17, 2025, we were astounded to learn via a Company 8-K that the Board, in an apparent move to entrench and enrich leadership, determined to further compensate themselves and Mr. Foley at the expense of shareholders. We believe this offensive action trounces shareholder rights and the Board’s fiduciary duties and further disenfranchises the Company’s true owners. It also makes clear to us that Cannae has not been engaging in good faith dialogue despite our persistent and sincere efforts, which necessitated the need to release this letter with the goal of reaching the entire Board and building a market consensus on the best path forward for the Company.

Carronade Has Nominated Four Highly Qualified Director Candidates

The fundamental role of a Board in its fiduciary duty to shareholders is to be an advocate in providing oversight of management and corporate strategy. Shareholders deserve a board that is proactive, transparent, and fully committed to driving long-term value. As evidenced by their backgrounds below, we believe our candidates will bring the expertise, independence and accountability required to correct the chronic underperformance of Cannae and champion its strategic transformation.

- Mona Aboelnaga

- 35 years of experience including at Siguler Guff & Company and Proctor Investment Managers with expertise in investment management and private equity industries.

- Extensive corporate governance expertise as a board member of both public and private companies including Webster Financial, a financial services company, Perpetual Limited, an Australian-based diversified global financial services company, and Sterling Bancorp, a regional financial services company.

- Benjamin Duster

- 45 years of experience including at Wells Fargo and Salomon Brothers with expertise in working with companies to improve execution effectiveness and create long-term sustainable value.

- Extensive public and private company board service including Expand Energy, an oil and gas production company, Weatherford International, a global energy services company, Republic First Bancorp, a commercial bank, and Alaska Communications Systems, a broadband and telecommunications service provider.

- Dennis Prieto

- 21 years of experience including at Aurelius Capital Management and Evercore with expertise in financial analysis and restructuring oversight.

- Significant investment management and board experience including GO Lab, a privately held building products company, Aventiv Technologies, a provider of telecommunications and technology solutions, Mohawk Gaming Enterprises, a gaming company, and Endo International GUC Trust, a trust established to obtain recoveries for creditors of Endo International plc.

- Cherie Schaible

- 24 years of experience including as General Counsel of Ankura Consulting Group and Associate General Counsel of AIG Investments with expertise in complex legal and financial matters.

- Extensive experience in structuring, negotiating and leading a variety of corporate legal matters in public and private companies.

Conclusion

We remain committed, engaged investors in Cannae due to our conviction in the significant opportunity for value creation that will flow from implementing achievable actions to unlock value, outlining a clear corporate strategy, establishing governance and restoring investor confidence. We repeat our request to meet in-person with the Board, including non-management directors, to discuss these proposals in more detail and explore a consensual solution that is in the best interests of all shareholders. If meaningful changes are not enacted, we are prepared to take our case to shareholders so that they have the opportunity to vote for directors who they believe will best prioritize their interests and ensure accountability in the boardroom.

Sincerely,

Dan Gropper

Managing Partner

Andy Taylor

Partner and Head of Research

About Carronade Capital

Carronade Capital is a multi-strategy investment firm based in Connecticut with over $2.2 billion in assets under management that focuses on process driven investments in catalyst-rich situations. Carronade Capital was founded in 2019 by industry veteran Dan Gropper and is based in Darien, Connecticut. The Funds managed by Carronade Capital were launched on July 1, 2020, and the firm employs 15 team members. Dan Gropper brings with him nearly three decades of special situations credit experience serving in senior roles at distinguished investment firms, including Elliott Management Corporation, Fortress Investment Group and Aurelius Capital Management, LP.

Media Contact:

Paul Caminiti / Jacqueline Zuhse

Reevemark

(212) 433-4600

[email protected]

Investor Contact:

Andy Taylor / Win Rollins

Carronade Capital Management, LP

(203) 485-0880

[email protected]

Disclaimers

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person. This press release does not recommend the purchase or sale of a security. There is no assurance or guarantee with respect to the prices at which any securities of Cannae Holdings, Inc. (the “Company”) will trade, and such securities may not trade at prices that may be implied herein. In addition, this press release and the discussions and opinions herein are for general information only, and are not intended to provide financial, legal or investment advice. Each shareholder of the Company should independently evaluate the proxy materials and make a decision that aligns with their own financial interests, consulting with their own advisers, as necessary.

This press release contains forward-looking statements. Forward-looking statements are statements that are not historical facts and may include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance. Forward-looking statements are generally identified by the words “expects”, “anticipates”, “believes”, “intends”, “estimates”, “plans”, “will be” and similar expressions. Although Carronade Capital and its affiliates believe that the expectations reflected in forward-looking statements contained herein are reasonable, investors are cautioned that forward-looking information and statements are subject to various risks and uncertainties—many of which are difficult to predict and are generally beyond the control of Carronade or the Company—that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. In addition, the foregoing considerations and any other publicly stated risks and uncertainties should be read in conjunction with the risks and cautionary statements discussed or identified in the Company’s public filings with the U.S. Securities and Exchange Commission, including those listed under “Risk Factors” in the Company’s annual reports on Form 10-K and quarterly reports on Form 10-Q . The forward-looking statements speak only as of the date hereof and, other than as required by applicable law, Carronade does not undertake any obligation to update or revise any forward-looking information or statements. Certain information included in this press release is based on data obtained from sources considered to be reliable. Any analyses provided herein is intended to assist the reader in evaluating the matters described herein and may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analyses should not be viewed as factual and should not be relied upon as an accurate prediction of future results. All figures are estimates and, unless required by law, are subject to revision without notice.

Certain of the funds(s) and/or account(s) managed by Carronade (“Accounts”) currently beneficially own shares of the Company. Carronade in the business of trading (i.e., buying and selling) securities and intends to continue trading in the securities of the Company. You should assume the Accounts will from time to time sell all or a portion of its holdings of the Company in open market transactions or otherwise, buy additional shares (in open market or privately negotiated transactions or otherwise), or trade in options, puts, calls, swaps or other derivative instruments relating to such shares. Consequently, Carronade’s beneficial ownership of shares of, and/or economic interest in, the Company may vary over time depending on various factors, with or without regard to Carronade’s views of the Company’s business, prospects, or valuation (including the market price of the Company’s shares), including, without limitation, other investment opportunities available to Carronade, concentration of positions in the portfolios managed by Carronade, conditions in the securities markets, and general economic and industry conditions. Without limiting the generality of the foregoing, in the event of a change in the Company’s share price on or following the date hereof, Carronade may buy additional shares or sell all or a portion of its Account’s holdings of the Company (including, in each case, by trading in options, puts, calls, swaps, or other derivative instruments relating to the Company’s shares). Carronade also reserves the right to change the opinions expressed herein and its intentions with respect to its investment in the Company, and to take any actions with respect to its investment in the Company as it may deem appropriate, and disclaims any obligation to notify the market or any other party of any such changes or actions, except as required by law.

Certain Information Concerning the Participants

Carronade Capital Management, LP, together with the other participants named herein (collectively, “Carronade Capital”), intends to file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes for the election of Carronade Capital’s highly-qualified director nominees at the 2025 annual meeting of stockholders of Cannae Holdings, Inc., a Nevada corporation (the “Company”).

CARRONADE CAPITAL STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated to be Carronade Capital Master, LP (“Carronade”), Carronade Capital, Carronade Capital GP, LLC (“Carronade GP”), Carronade Capital Management GP, LLC (“Carronade Management GP”), Dan Gropper, Mona Aboelnaga, Benjamin C. Duster, IV, Dennis A. Prieto and Chérie L. Schaible.

As of the date hereof, Carronade beneficially owns directly 2,627,877 shares of Common Stock, par value $0.0001 per share, of the Company (the “Common Stock”). Carronade GP, as the general partner of Carronade, may be deemed the beneficial owner of the 2,627,877 shares of Common Stock owned by Carronade. As of the date hereof, 262,770 shares of Common Stock were held in a certain account managed by Carronade Capital (the “Managed Account”). Carronade Capital, as the investment manager of Carronade, may be deemed the beneficial owner of an aggregate of 2,890,647 shares of Common Stock directly owned by Carronade and held in the Managed Account. Carronade Management GP, as the general partner of Carronade Capital, may be deemed the beneficial owner of an aggregate of 2,890,647 shares of Common Stock directly owned by Carronade and held in the Managed Account. As the Managing Member of Carronade Management GP, Mr. Gropper may be deemed the beneficial owner of an aggregate of 2,890,647 shares of Common Stock directly owned by Carronade and held in the Managed Account. As of the date hereof, Ms. Aboelnaga directly beneficially owns 800 shares of Common Stock. As of the date hereof, Mr. Duster directly beneficially owns 1,338.329 shares of Common Stock. As of the date hereof, Mr. Prieto directly beneficially owns 820 shares of Common Stock. As of the date hereof, Ms. Schaible directly beneficially owns 1,360 shares of Common Stock.

____________________________

Note: All analyses performed as of 3/17/2025.

1 Ryan Caswell on Q3 2024 Earnings Call.

2 Current GAV plus realized sales compared to original cost basis of DNB, ALIT, PSFE, and SST.

3 Company published NAV reports.

4 TSR per Bloomberg as of 3/17/2025. Average cumulative shareholder return. TSR Proxy Peers include APO, FSK, GBDC, PSEC, CODI, NMFC. Closed End Fund Peers include UTG, STEW, KYN, CET, GAM, IGR, EOI, MEGI, PEO.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/77496dfe-1ffc-44b7-94dd-bbd69816468b