BRISBANE, Australia, Jan. 28, 2026 (GLOBE NEWSWIRE) — Elevra Lithium Limited (“ELV” or “Company”) (ASX: ELV; NASDAQ: ELVR; OTCQB: SYAXF) delivered record quarterly revenue and a gross profit at NAL, while the production outlook was adjusted to reflect short term operational conditions.

North American Lithium

- Second best quarterly safety performance since recommencing operations in 2023.

- Ore mined of 389,801 wet metric tonnes (wmt) was 15% higher quarter on quarter (QoQ).

- Process plant utilisation improved to 89%, a 2% increase QoQ.

- Lithium recovery for the quarter was 62%, down 7% QoQ as a consequence of pit development sequencing adjacent to historical underground workings which in turn resulted in temporary lower feed grade and a larger proportion of higher iron content in feed material.

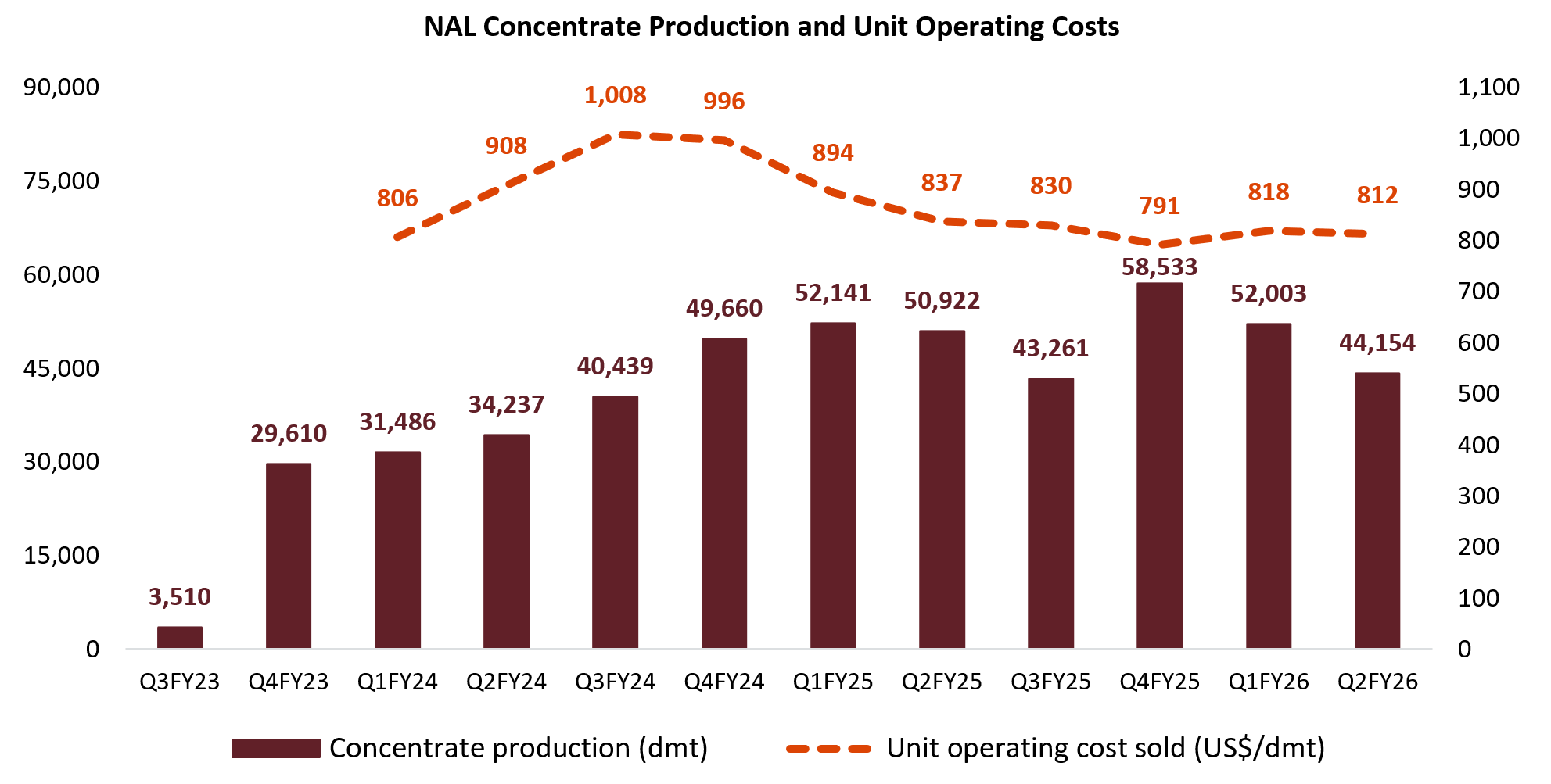

- Spodumene concentrate production declined by 15% to 44,154 dry metric tonnes (dmt) at an average grade of 4.9%. The reduced concentrate production and grade were a function of lower lithium recovery, as the higher iron content necessitated increased use of the WHIMS (wet high intensity magnetic separators).

- Spodumene sales were 66,016 dmt, in line with prior guidance to weight sales toward the December 2025 quarter1. There were two cargoes sold during the December 2025 quarter which aligns with Elevra’s strategy to ship larger cargoes to achieve freight savings.

- The average realised selling price (FOB) increased by 27% to US$998/dmt versus the prior quarter, reflecting the benefit of improved lithium market fundamentals and Elevra’s leverage to rising spot prices.

- Unit operating costs (per tonne sold) for NAL were US$812/dmt, a modest decrease compared to US$818 in the prior quarter, resulting in NAL generating a quarterly gross profit for the second time since the restart of operations.

- Capital expenditure of US$7 million for the quarter was on budget and primarily related to the upgrade of the Tailings Storage Facility and other NAL sustaining projects.

Growth Projects

NAL Expansion

- Following completion of the December 2025 quarter, Elevra issued an update on the NAL Expansion which offered an accelerated timeline to increase annual production and reduce unit operating costs by implementing a phased approach to the expansion2.

Moblan

- Planned baseline environmental field activities were undertaken during the December 2025 quarter and studies progressed.

Ewoyaa

- Ratification of the Ewoyaa Mining Lease by the Parliament of Ghana is ongoing. Advancement of the project remains contingent on Mining Lease ratification, prevailing market conditions and the availability and structure of suitable project financing.

Carolina Lithium

- During the December 2025 quarter, Carolina Lithium obtained General Stormwater Permits for the proposed mine and conversion plant advancing key environmental permitting milestones.

- In addition, Elevra engaged with local officials, community stakeholders and relevant US government agencies in relation to the next stages of project development, including discussions related to the project’s strategic importance to a US domestic lithium supply chain.

Corporate

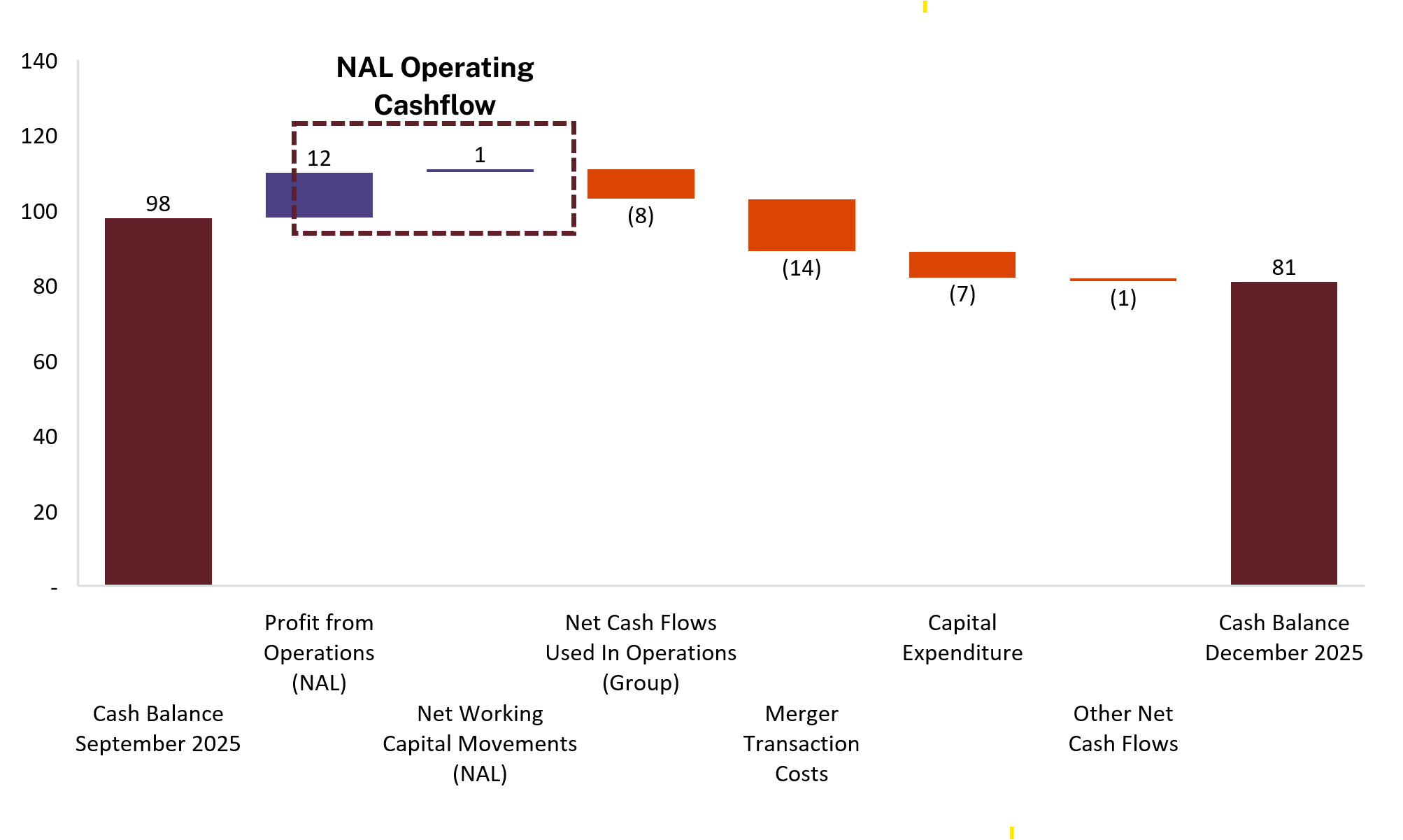

- Cash at the December 2025 quarter end was US$81 million, reflecting change-of-control payments and merger-related advisory fees incurred during the period.

- Elevra appointed Christian Cortes as Chief Financial Officer during the quarter, supporting the Company’s operational focus and continued development and growth initiatives.

- All resolutions were successfully passed at the Elevra AGM on 21 November 2025, including election of the four selected ex-Piedmont directors.

- Merger related cost synergies remain on track to deliver targeted savings. An update will be provided with the HY26 Interim Results in late February 2026.

- Elevra has revised FY26 production, sales and cost guidance after reviewing results for the half year – providing a more conservative outlook for the next several quarters. The Company believes it prudent to lower production guidance for the short term until the benefits of increased grade control drilling and improved ore blending are realised. The current operational conditions are not representative of the NAL Life of Mine (LOM) orebody, hence the adjustment applies to near term guidance only.

| Unit | Current Guidance | Prior Guidance3 | ||

| Spodumene concentrate production | Dmt | 180,000 – 190,000 | 195,000 – 210,000 | |

| Spodumene concentrate sales | Dmt | 170,000 – 190,000 | 195,000 – 210,000 | |

| Unit operating cost sold | US$/dmt | US$860 – US$880 | US$765– US$830 | |

| Capital expenditures | US$M | US$26 | US$26 | |

Management Commentary

Despite a challenging operating environment at NAL, the Company delivered a significant increase in revenue and positioned the business to capitalise on improving lithium market conditions and future growth at NAL.

The December 2025 quarter was the first full quarter of operations following the completion of the Sayona-Piedmont merger. Management focused on integrating the combined organisation, aligning operational and corporate functions, and maintaining disciplined execution across the Company’s asset portfolio during the transition period.

Operationally, the December 2025 quarter was challenging. Spodumene concentrate production declined compared to the prior quarter, primarily as a result of reduced lithium recoveries associated with lower lithium grades and higher iron content in the ore feed. In response to these conditions grade control drilling density will be increased in the areas adjacent to historical underground workings which will enhance scheduling and allow improved ore blending to reduce the impact of high iron ore on recoveries.

Consequently, the Company has revised its production guidance until the benefits of increased grade control drilling and improved ore blending are realised.

Despite these headwinds, unit costs remained broadly consistent with the September 2025 quarter; however, the revised FY2026 cost guidance incorporates additional short-term expenditure associated with ore blending and grade control initiatives as the Company deliberately works through this section of the mine.

Financial performance during the December 2025 quarter was robust with 66,016 dmt sold at an average realised price (FOB) of US$998/dmt. Revenue increased significantly, consistent with the Company’s strategy to weight sales to the second quarter of FY26 and improved realised pricing.

The increase in revenue highlights the Company’s leverage to improving market conditions and underscores Elevra’s ability to generate meaningful cash flow in a recovering market environment. Despite the short-term operational challenges outlined above, NAL continued to generate operating cash flow during the quarter, underpinned by strong realised pricing, disciplined sales execution and resilient underlying operating performance.

In parallel with our operational focus, the Company continued to advance its development portfolio at Moblan, Ewoyaa and Carolina Lithium. Activities across these projects are progressing at a measured pace to reflect management’s deliberate prioritisation of operational performance at NAL. At Ewoyaa, the Mining Lease continued to progress towards Ghanian Government ratification, while efforts at Moblan and Carolina Lithium remained focused on mid to longer-term project development and positioning the assets within a growing North American lithium supply chain.

Looking forward, management remains encouraged by improving sentiment in the global lithium market and the continued strengthening in lithium pricing. In this context, the Company is advancing plans to increase annual output at NAL at an accelerated rate. We continue to work co-operatively with the Quebec and Federal Governments to enable permits and approvals to be finalised as the staged expansion requires.

The ability to pursue this growth in a unified and expeditious manner was a primary strategic rationale underpinning the Sayona-Piedmont merger, and management believes the current market environment presents an opportunity to make a meaningful, forward-looking investment into the future of NAL.

With operational and development activities progressing and production guidance appropriately updated, Elevra is well positioned to execute on its growth strategy while maintaining operational discipline and delivering long-term value.

Mr Lucas Dow

Managing Director and CEO

Operational Financial Performance

| Unit | Q2 FY26 |

Q1 FY26 |

QoQ Variance |

YTD FY26 |

YTD FY25 |

YTD Variance |

|

| North American Lithium4 | |||||||

| Ore mined | wmt | 389,801 | 338,341 | 15% | 728,142 | 610,683 | 19% |

| Recovery | % | 62 | 69 | (7%) | 66 | 67 | (1%) |

| Concentrate produced | dmt | 44,154 | 52,003 | (15%) | 96,156 | 103,063 | (7%) |

| Concentrate grade produced | % | 4.9 | 5.2 | (0.3%) | 5.0 | 5.3 | (0.3%) |

| Concentrate sold | dmt | 66,016 | 25,975 | 154% | 91,991 | 115,027 | (20%) |

| Average realised selling price (FOB)5 | US$/dmt | 998 | 784 | 27% | 937 | 697 | 35% |

| Revenue | US$M | 66 | 20 | 223% | 86 | 80 | 8% |

| Unit operating cost sold (FOB)6 | US$/dmt | 812 | 818 | (0.7%) | 814 | 861 | (6%) |

| Group | |||||||

| Cash balance | US$M | 81 | 98 | (17%) | 81 | 69 | 17% |

| USD : CAD | $ | 1.394 | 1.377 | 1% | 1.386 | 1.382 | — |

| USD : AUD | $ | 1.523 | 1.528 | — | 1.526 | 1.513 | 1% |

Health and Safety

The Total Recordable Injury Frequency Rate (“TRIFR”) increased during the December 2025 quarter with two lost time injuries recorded following six consecutive months with no lost time injuries. Despite the QoQ increase in TRIFR, this was the second-best safety performance since the restart of operations in 2023. In addition, there were two separate sequences of more than 40 days without any recordable injuries.

The positive trend in safety outcomes is a direct result of strong day-to-day safety discipline across the organisation as teams continue to demonstrate their commitment to proactive and collaborative safety management.

ESG and Community Engagement

Elevra progressed several studies required to support the potential NAL expansion and development of Moblan, and the Company received key permits for future mining and conversion operations at Carolina Lithium. NAL produced an initial self-declaration for Canada’s Towards Sustainable Mining initiative, and the Company is advancing an action plan to achieve Level A certification by the end of CY2027.

During the December 2025 quarter, Elevra continued its community engagement activities in the vicinity of North American Lithium. Elevra also provided updates to local officials and landowners in Gaston County in support of the Carolina Lithium project, outlining the process and considerations associated with future project development activities.

North American Lithium

Mining

Ore mined of 389,801 wmt was 15% higher than the previous quarter but at a lower lithium grade of 1.06% delivered to the ROM stockpile.

Mining activity during the quarter focused upon stripping and ore extraction from Phase 3 in order to suitably advance pit development for future mining activities.

Spodumene concentrate production for the quarter was below forecast due to lower than anticipated ore availability around historical underground workings. This resulted in ore being predominantly sourced from volcanic hosted areas of the pit throughout the quarter at a lower lithium grade than anticipated. Whilst volcanic hosted ore typically has higher iron content, the area available for mining over the quarter had an iron content well above the life of mine average. As such the conditions currently being encountered adjacent to historical underground workings are not considered representative of the broader orebody.

These factors combined to materially affect recovery and concentrate production during the quarter.

Grade control drilling density will be increased in the areas of historical underground workings which will enhance scheduling and allow improved ore blending to reduce the impact of high iron ore. Additionally, it is anticipated that mining will progress over the next several quarters out of areas with above average iron content.

Production

Production declined to 44,154 dmt of spodumene concentrate (down 15% QoQ) for the December 2025 quarter resulting from lower recovery with high iron content and lower lithium feed grade.

The mill processed 351,592 tonnes of ore (up 3% QoQ) at an average feed grade of 0.98% Li2O, with some lower grade stockpiled ore complementing ore mined.

Mill utilisation was 89%, a 2% QoQ increase, and broadly consistent with target levels. Mill utilisation was impacted by a planned shutdown to reline the rod mill, while mill throughput for the December 2025 quarter achieved a new record in terms of volume processed.

The Li2O recovery for the December 2025 quarter was 62%, a decline from 69% in the September 2025 quarter, as a reduction in feed grade and an increase in iron content negatively impacted performance. The quarter’s mill feed necessitated increased use of the WHIMS which yielded lower production and a reduction in average concentrate grade to 4.9%.

Increased grade control drilling density, alterations to stockpiling and blending strategies and a continued focus on minimising dilution are actions that will be deployed to manage higher iron pockets coming from the Phase 3 mining area. All of these actions are focussed on improving recoveries whilst we transition through this higher iron area of the mine.

Figure 1: NAL Global Recovery and Mill Utilisation

Figure 2: NAL Concentrate Production and Unit Operating Costs (sold)

Sales

NAL revenue was US$66 million for the December 2025 quarter, which set a quarterly record for the operation.

The increase in revenue resulted from a 154% increase in spodumene concentrate tonnes sold by NAL and a 27% increase in average realised price per tonne (FOB). Total spodumene concentrate sold during the December 2025 quarter was 66,016 dry metric tonnes, with two cargoes sold during the quarter.

The average realised selling price (FOB) for the December 2025 quarter was US$998/dmt. This strong price realisation reflected improving market conditions, which saw spodumene concentrate prices increase to multi-year highs on rising demand and reduced expectations for a near-term restart of idled capacity.

A total of 29,913 tonnes of spodumene concentrate finished goods was stockpiled at NAL, in transit or at the Port of Québec as at 31 December 2025. Shipments for the remainder of the year are expected to be evenly split across the March and June Quarters.

Costs

Unit operating costs (FOB) for NAL were slightly lower than the prior quarter at US$812/dmt sold.

Total ore mining and waste stripping costs increased 14% QoQ, which coincided with a 15% increase in tonnes of ore mined and 1% increase in waste stripped and mined.

A 3% decrease in ore processing expenditure for the December 2025 quarter was attributable to increased availability of the crusher and mill.

In-pit and ROM inventory at the end of the December 2025 quarter declined from the previous quarter, primarily due to reduced in-pit ore tonnage stemming from historical underground mining activity. Additional crushed ore was added to the crushed ore dome to serve as a buffer between the crushing circuit and the mill to mitigate potential weather impacts during winter – this proved to be an effective strategy.

Finished goods inventory decreased as a result of increased shipments and reduced production compared to the September 2025 quarter.

Growth Projects

NAL Brownfield Expansion

Following the release of the NAL Expansion Scoping Study in mid-September 20257, progress continued with a focus on confirming permitting requirements, advancing environmental and technical studies, and preparing for feasibility work.

The expansion case was submitted to the relevant Federal and Provincial authorities for Environmental and Social Impact Assessment (“ESIA”) determination. Supporting studies progressed, including work in the areas of ecological fieldwork, preliminary geotechnical, hydrogeological and hydrology investigations, and additional hydrogeological testing near the planned expansion area.

Following the conclusion of the December 2025 quarter, Elevra announced an accelerated expansion plan for NAL which reflected further refinement of the project development pathway8. By leveraging additional permitting information received during the December 2025 quarter, the Company identified a staged series of debottlenecking steps that are expected to bring forward incremental production in a disciplined and capital efficient manner. The revised strategy is anticipated to deliver an initial 15-20% increase in annual spodumene concentrate production above current levels by mid-CY2027 with further staged expansions progressing toward the outlined production target of 315,000 tonnes per annum.

In support of this approach, Elevra plans to update the Scoping Study in early Q2 CY2026 and advance directly to detailed engineering to further de-risk execution and accelerate value creation at NAL.

Moblan

Fieldwork at the Moblan project was undertaken, and an ecological study was finalised while additional studies are expected to be completed in the coming weeks. A project notice to advance, marking the next step in the regulatory and development process, is also planned to complete in the second half of FY2026.

Ewoyaa

Development of Ewoyaa remains subject to ratification of the Mining Lease, prevailing market conditions and attainment of suitable project financing.

Prior to the adjournment of Parliament over Christmas and the New Year, the Ministry of Lands and Natural Resources also submitted a new Legislative Instrument which sets out a sliding scale royalty rate for mining projects in Ghana. The Legislative Instrument will be considered in line with due parliamentary process, as a separate item to the Mining Lease.

Carolina Lithium

During the December 2025 quarter, Elevra continued to advance permitting and stakeholder engagement activities for the Carolina Lithium project. The Company received General Stormwater Permits covering both the proposed mine and conversion plant operations, representing an important step in the environmental permitting process, while continuing to work constructively with the North Carolina Department of Environmental Quality’s Division of Air Quality to advance the project’s air permit application.

In parallel, the Company maintained ongoing dialogue with County officials and local community stakeholders to support preparedness for the next stages of development of the Carolina Lithium project. In addition, Elevra continued to engage with relevant US Federal government agencies regarding the strategic importance of the Carolina Lithium project and to explore potential opportunities to increase domestic lithium supply and support broader energy security initiatives.

Western Australia

Morella Lithium Joint Venture Project

Elevra has a 49% equity interest in the Morella Lithium Joint Venture, which holds lithium rights in the Pilbara and South Murchison regions. The joint venture is managed by Morella Corporation Limited (ASX: 1MC).

In the Pilbara JV area, a rock chip sampling program of exposed pegmatite outcrops confirmed lithium-caesium-tantalum (LCT)-type pegmatites across the project area. While sampling showed low concentrations of lithium, the results confirmed the presence of rubidium mineralisation and indicated geologic potential for LCT-system development.

At Mt Edon in the South Murchison, hydrometallurgical test work performed by Edith Cowan University yielded high rates of rubidium extraction, peaking at 93.6% in Phase 2 test work, and provided the foundation for evaluating processing pathways and economic evaluation9.

Tabba Tabba

Elevra holds the lithium and pegmatite rights over the Tabba Tabba project (E45/2364) where exploration is targeting gabbro hosted, flat lying spodumene pegmatite systems. The lease is well located being directly south and along strike from known lithium mineralisation.

In the North drill area a review of drill data has identified a key zone of untested, favourable geology along the western flank of the Corridor Gabbro. At the Pascal pegmatite cluster, 3km along strike to the south, mapping continued to identify untested pegmatite occurrences.

Drilling data collected to date from the North zone and Pascal corridor provide keys to advancing the project and has identified high priority reverse circulation (RC) drill targets. Heritage surveying is planned, following which initial RC drill testing is scheduled for late calendar 2026.

Corporate

Outlook

Updated FY26 Guidance

Elevra has revised FY26 production, sales and cost guidance after reviewing results for the half year providing a more conservative outlook for the next several quarters. The Company believes it prudent to lower production guidance until the benefits of increased grade control drilling and improved ore blending are realised.

| Unit | Current Guidance | Prior Guidance 10 | |

| Spodumene concentrate production | dmt | 180,000 – 190,000 | 195,000 – 210,000 |

| Spodumene concentrate sales | dmt | 170,000 – 190,000 | 195,000 – 210,000 |

| Unit operating cost sold | US$/dmt | US$860 – US$880 | US$765 – US$830 |

| Capital expenditures | US$M | US$26 | US$26 |

Appointment of Christian Cortes as Chief Financial Officer

During the December 2025 quarter Elevra announced the appointment of Christian Cortes as the Company’s Chief Financial Officer (effective 20 October 2025), following the resignation of Dougal Elder11.

Mr. Cortes brings more than 20 years of international experience in the finance and resources sector, including as the Chief Integration and Transformation Officer at Arcadium Lithium and Chief Financial Officer and Chief of Sales and Marketing at Allkem Limited. His deep sector expertise and strategic financial leadership will play an important role in supporting Elevra’s growth.

AGM

The first Elevra Lithium Annual General Meeting was held on 21 November 2025. All resolutions were successfully passed, including election of the four selected ex-Piedmont directors.

Cash

Cash and cash equivalents decreased by US$16.6 million to end the December 2025 quarter with a resulting balance of US$81.3 million.

NAL generated profit from operations of US$12 million for the December 2025 quarter, driven primarily by increased sales volumes, higher realised prices and stable unit operating costs. Overall, NAL reported a net operating cash inflow of US$13 million as a result of profit generated from operations and favourable net working capital movements inclusive of a reclassification of cash to other financial assets of US$2M associated with cash backed guarantees for future rehabilitation costs.

Outside of NAL, the Group reported a net operating cash outflow of US$8 million for the December 2025 quarter, comprised of corporate expenditure of US$6 million and negative net working capital movements of US$2 million.

Elevra paid US$14 million in merger transaction costs for change of control payments and advisor fees. Capital expenditure in the December 2025 quarter was US$7 million related to upgrading the Tailings Storage Facility and various other NAL sustaining capital projects.

Figure 3: Net cash flows for December 2025 Quarter

Merger related cost synergies remain on track to deliver targeted savings. An update will be provided with the HY26 Interim Results in late February 2026.

Capital Structure

At 31 December 2025, the Company had the following capital structure:

- 169,329,111 ordinary fully paid shares;

- 2,723,613 unquoted options expiring on 31 December 2028;

- 1,760,737 unquoted performance rights (expiring various dates).

Announcement authorised for release by Mr Lucas Dow, Managing Director and CEO of Elevra Lithium Limited.

Information

The following information applies to this report:

- All references to dollars and cents are United States currency, unless otherwise stated.

- Numbers presented may not add up precisely to the totals provided due to rounding.

The following abbreviations may have been used throughout this report: cost, insurance and freight (CIF); dry metric tonne (dmt); earnings before interest and tax (EBIT); earnings before interest, tax, depreciation and amortisation (EBITDA); free on board (FOB); life of mine (LOM); lithium carbonate (Li2CO3); lithium hydroxide (LiOH); lithium oxide (Li2O); net present value (NPV); run of mine (ROM); thousand tonnes (kt); tonnes (t); and wet metric tonne (wmt).

Forward-Looking Statements

This report may contain certain forward-looking statements. Such statements are only predictions, based on certain assumptions and involve known and unknown risks, uncertainties and other factors, many of which are beyond Elevra Lithium Limited’s control. Actual events or results may differ materially from the events or results expected or implied in any forward-looking statement. The inclusion of such statements should not be regarded as a representation, warranty or prediction with respect to the accuracy of the underlying assumptions or that any forward-looking statements will be or are likely to be fulfilled.

Elevra Lithium Limited undertakes no obligation to update any forward-looking statement or other statement to reflect events or circumstances after the date of this report (subject to securities exchange disclosure requirements).

The information in this report does not take into account the objectives, financial situation or particular needs of any person. Nothing contained in this report constitutes investment, legal, tax or other advice.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original market announcement and all material assumptions and technical parameters continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcements.

About Elevra Lithium

Elevra Lithium Limited (ASX: ELV; NASDAQ: ELVR; OTCQB: SYAXF) is North America’s largest hard-rock lithium producer with a diversified portfolio of high-quality assets across Québec Canada, the United States, Ghana and Western Australia.

Our flagship operation, the North American Lithium (NAL) mine in Québec, Canada has successfully ramped up production of spodumene concentrate, supported by ongoing operational enhancements to increase recovery rates, throughput, and mill utilisation. Following a Mineral Resource upgrade, Elevra completed a Scoping Study for a brownfield expansion to increase NAL’s annual spodumene concentrate production and reduce unit operating costs.

Complementing NAL, the Moblan Lithium Project in northern Québec represents one of the largest undeveloped spodumene resources in North America, with a Mineral Resource of 121 Mt @ 1.19% Li₂O. Development activities are progressing with feasibility studies targeting a large-scale, long-life operation capable of supplying both domestic and international markets.

In Western Australia, Elevra holds an extensive portfolio of lithium and gold tenements, where exploration programs are advancing to unlock additional growth opportunities. Meanwhile, in the United States, our Carolina Lithium Project offers a strategic foothold in the downstream lithium chemicals market and our project in Ghana provides a further option for future growth.

Looking ahead, Elevra is focused on strategic downstream partnerships to enable further value-added lithium production, positioning the Company to deliver a secure, sustainable supply of critical minerals to global customers. Together, these assets establish Elevra as a growth-focused supplier supporting the global energy transition.

For more information, please visit us at www.elevra.com.

Appendix

| Unit | Q2 FY25 | Q3 FY25 | Q4 FY25 | Q1 FY26 | Q2 FY26 | |

| Physicals12 | ||||||

| Ore mined | wmt | 370,409 | 322,407 | 361,883 | 338,341 | 389,801 |

| Ore crushed | wmt | 342,752 | 292,962 | 379,353 | 349,698 | 361,485 |

| Ore processed | dmt | 342,855 | 287,782 | 357,290 | 341,780 | 351,592 |

| Concentrate produced | dmt | 50,922 | 43,261 | 58,533 | 52,003 | 44,154 |

| Concentrate sold | dmt | 66,035 | 27,030 | 66,980 | 25,975 | 66,016 |

| Unit Metrics | ||||||

| Average realised selling price (FOB)13 | US$/dmt | 686 | 710 | 682 | 784 | 998 |

| Unit operating cost sold (FOB)14 | US$/dmt | 837 | 830 | 791 | 818 | 812 |

| Production Variables | ||||||

| Mill utilisation | % | 90% | 80% | 93% | 87% | 89% |

| Recovery | % | 68% | 69% | 73% | 69% | 62% |

| Concentrate grade produced | % | 5.3% | 5.2% | 5.2% | 5.2% | 4.9% |

___________________________

1 See ASX release 15 September 2025 “Market Update Presentation”.

2 See ASX release 12 January 2026 “Accelerated NAL Expansion”.

3 As a result of the Company’s transition from reporting in Australian dollars to US dollars, the prior guidance ranges for unit operating cost sold and capital expenditures have been converted using AUD:USD = 0.65.

4 Numbers presented may not add up precisely to the totals provided due to rounding.

5 Average realised selling price is calculated on an accruals basis and reported in US$/dmt sold, FOB Port of Québec.

6 Unit operating cost sold is calculated on an accruals basis and includes mining, processing, transport, port charges, site-based general and administration costs and cash based inventory movements, and excludes depreciation and amortization charges, freight and royalties. It is reported in US$/dmt sold, FOB Port of Québec.

7 See ASX release 15 September 2025, “NAL Expansion Scoping Study”.

8 See ASX release 12 January 2026, “Accelerated NAL Expansion”.

9 See ASX release 25 November 2025, “1MC:Mt Edon Rubidium Testwork Confirms High Grade Recoveries”.

10 As a result of the Company’s transition from reporting in Australian dollars to US dollars, the prior guidance ranges for unit operating cost sold and capital expenditures have been converted using AUD:USD = 0.65.

11 See ASX release 20 October 2025, “Resignation and Appointment of CFO”.

12 Numbers presented may not add up precisely to the totals provided due to rounding.

13 Average realised selling price is calculated on an accruals basis and reported in US$/dmt sold, FOB Port of Québec.

14 Unit operating cost sold is calculated on an accruals basis and includes mining, processing, transport, port charges, site-based general and administration costs and cash based inventory movements, and excludes depreciation and amortisation charges, freight and royalties. It is reported in US$/dmt sold, FOB Port of Québec.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/bd2cc0aa-5dad-48a7-86ae-e3da7e825ece

https://www.globenewswire.com/NewsRoom/AttachmentNg/f6f3e3e1-856a-49e8-826a-064fc2a076bd

https://www.globenewswire.com/NewsRoom/AttachmentNg/6b42ca4b-ceea-4f4e-9bed-d4f0007f5d06