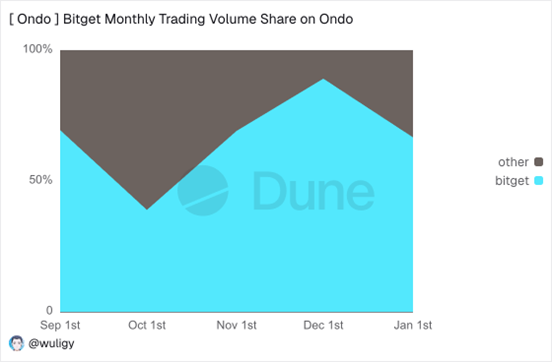

VICTORIA, Seychelles, Jan. 14, 2026 (GLOBE NEWSWIRE) — Bitget, the world’s largest Universal Exchange (UEX), announced a significant expansion of its leadership in tokenized equities, capturing approximately 89% of total market share on Ondo in the month of December 2025 — further up from 73% in the first week of December. The increase reflects accelerating demand for on-chain access to global equities and positions Bitget as the dominant venue for tokenized stock trading as participation broadens across regions.

As earnings season approaches, Bitget has extended its zero-fee trading campaign for tokenized stocks through April 30, 2026, providing users with more than three months of fee-free access. The program removes transaction fees and gas fees across all trade types—including buy, sell, limit, and market orders—offering a clear window for users to engage with tokenized equities under transparent, predictable cost conditions.

“Tokenized stocks are growing rapidly to a core trading vertical at Bitget,” said Gracy Chen, CEO of Bitget. “Capturing the majority of market activity shows that users are looking for continuous, cost-efficient access to global equities through on-chain infrastructure. By extending zero-fee trading and expanding our stock token lineup, we’re lowering the barriers for both crypto-native and traditional investors to participate in global markets from a single platform.”

Product expansion has accompanied the surge in activity. On January 9, Bitget listed 98 additional U.S. stocks and exchange-traded funds, bringing the platform’s total to more than 200 tokenized stock offerings. Users can trade leading global companies such as Apple, Tesla, Nvidia, and Alphabet with USDT settlement, enabling equity-style exposure without traditional brokerage accounts while preserving digital-native trading workflows.

Engagement metrics reflect the pace of adoption. Since the stock product launch in September, over one million users have interacted with tokenized stock products on Bitget. Trading activity has been especially concentrated in Ondo-issued assets, highlighting strong liquidity formation and execution efficiency as capital migrates on-chain.

The growth aligns with Bitget’s Universal Exchange (UEX) vision, which integrates crypto, tokenized equities, and other real-world assets within a single ecosystem. As more capital seeks continuous, borderless exposure to traditional markets via blockchain infrastructure, platforms capable of supporting both digital and traditional assets at scale are becoming increasingly vital for the emerging financial space. Bitget’s expanding share and sustained user growth signal where tokenized equities are headed—and how quickly this segment is maturing.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

For media inquiries, please contact: [email protected]

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/54e0810c-2ae9-4eee-956e-04260f5b2ff0

https://www.globenewswire.com/NewsRoom/AttachmentNg/8cfc4be5-6fe0-4387-9db2-081308d1022a