NEW YORK, March 17, 2025 (GLOBE NEWSWIRE) — CompStak, the leading platform of commercial real estate (CRE) data and analytics, today announced the launch of Portfolios, a powerful new product that enables CRE professionals to aggregate, analyze, and compare property data. With real-time insights and benchmarking capabilities, Portfolios streamlines workflows and empowers users to make smarter, data-driven asset management decisions.

For years, asset management professionals have struggled with the challenge of understanding the performance of their portfolios and the underlying assets in those portfolios against the market and their peers. Without a centralized tool powered by accurate market data, benchmarking entire groups of properties, tracking tenant risk exposure, and assessing portfolio performance against the market has been nearly impossible.

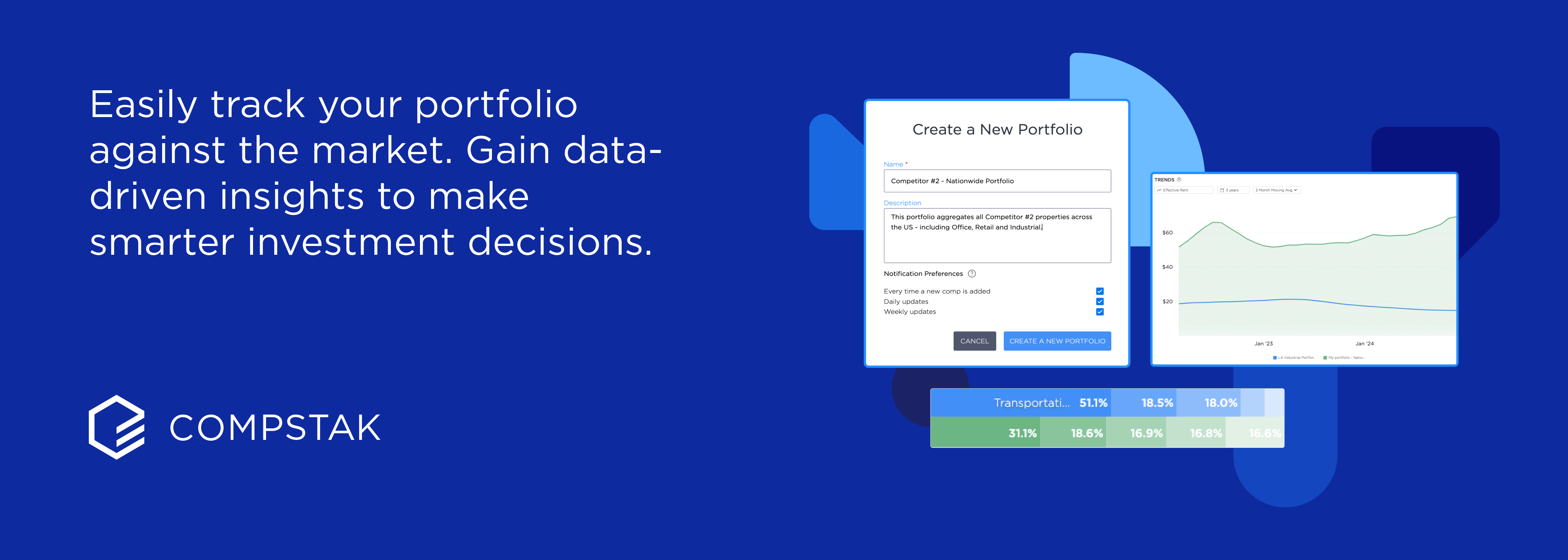

CompStak Portfolios changes that. By delivering accurate, localized, and real-time data in one platform, CompStak provides a game-changing solution for asset management, acquisitions, and REIT tracking.

“Over the past 13 years, CompStak has compiled the most robust, granular, and accurate database of lease and sale transaction data. With the launch of Portfolios, we’re taking CRE data analysis to the next level by allowing our clients to leverage that data in a robust benchmarking tool,” said Michael Mandel, CEO and Co-Founder of CompStak. “Our clients and users need real-time, accurate insights to make informed decisions. This new product offering not only eliminates the pain of manually tracking properties, but also provides powerful benchmarking and risk assessment tools for a strategic edge.”

Portfolios enables users to:

- Outperform Competitors – Compare portfolio and asset performance against markets, submarkets and competitive properties.

- Guide Investment Decisions – Track portfolios and assets that are underperforming or outperforming to identify investment opportunities that align with your goals.

- Mitigate Risk – Track tenant and industry exposure, lease expirations, and rent trends to proactively mitigate portfolio risks.

- Streamline Workflows – Access centralized, real-time portfolio insights without juggling multiple datasets.

Portfolios is a key addition to CompStak One, CompStak’s comprehensive suite of CRE data solutions, including Lease Comps, Sale Comps, Loan Data, Property Information, and Analytics. Click here to learn more about Portfolios and request a demo.

About CompStak

CompStak creates transparency in commercial real estate markets by gathering information that is hard to find, difficult to compile, or otherwise unavailable. Since 2012, CompStak has delivered this unmatched insight to a network of tens of thousands of members and clients, including Tishman Speyer, Wells Fargo, Metlife, and every major brokerage nationwide. CompStak Exchange is an exclusive platform for CRE brokers, appraisers, and researchers to get analyst-reviewed commercial comps and property details for free. Through CompStak One, lenders, landlords, and investors can access granular CRE data and market analytics to power better CRE decisions.

For media inquiries, contact:

Brigette Palombo

[email protected]

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/66639d5b-6b43-4056-89ae-0d6aba99de84

https://www.globenewswire.com/NewsRoom/AttachmentNg/cc0cf736-fd76-4c40-913a-c9e7338ee010