NEW YORK, Feb. 26, 2025 (GLOBE NEWSWIRE) — RentRedi, the fastest-growing all-in-one property management software that makes renting easy for both landlords and renters, has released survey results indicating that real estate investors in the United States are embracing a strong growth mindset in 2025, with a majority planning to expand their portfolios and invest significant amounts of money improving their current properties. The RentRedi survey, which analyzes responses by region and landlord size, highlights notable trends in investment strategies, renovation spending, and business priorities.

According to the survey, conducted between November 7-22, 2024, 59% of RentRedi landlords in the U.S. plan to buy property during 2025. Landlords in the Midwest and South are the most likely to acquire new properties at 69% each, with Northeast landlords slightly behind at 68%, Landlords in the Western U.S. are the only group that lags behind the national average, with 52% of landlords planning to purchase property. Breaking the numbers down by landlord size shows that 73% of large landlords (20+ rental units) are likely to acquire new property in 2025, followed by medium landlords (5-19 rental units) at 69% and small landlords (1-4 rental units) at 63%.

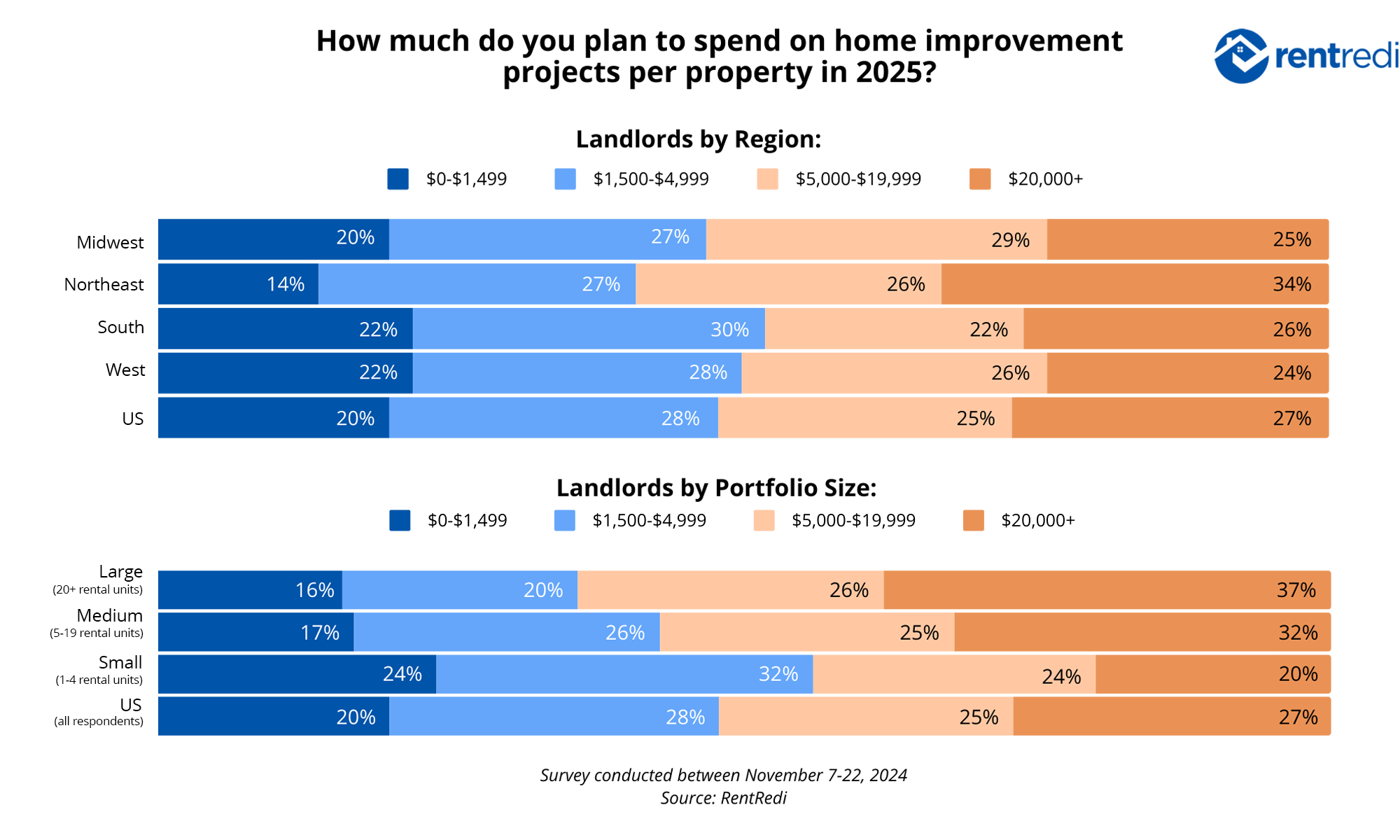

Beyond acquisitions, U.S. landlords are also prioritizing property improvements, with 52% of investors planning to spend at least $5,000 or more per unit on home improvement projects. Nationally, 27% of landlords plan to invest at least $20,000 per property on renovations. Large landlords are leading this trend, with 37% allocating $20,000+ per unit, compared to 20% of small landlords. Regionally, the Northeast shows the strongest commitment to significant renovations, with 60% budgeting more than $5,000 per property, while the South has the most conservative spending approach, with 52% budgeting less than $5,000 per property.

Regardless of location or portfolio size, landlords are focused mostly on income generation in 2025, with no group deviating significantly from the 47% national average. A significant amount of landlords also list long-term investment (33%) and financial freedom (19%) are their primary goals in managing rental properties in 2025. Short-term value increases appear to be the least priority (1%), reinforcing the perspective that real estate remains a long-term wealth-building strategy for most Americans.

The majority of landlords (43%) are prioritizing revenue growth this year, and 31% of landlords view time commitment as the main barriers to reaching their goals. Other operational hurdles including increased maintenance costs, property taxes, and insurance costs, as well as more stringent laws and regulations, remain steady among landlords across all regions and portfolio sizes.

“Removing operational barriers and time constraints are where RentRedi can be most impactful in helping landlords reach their growth goals in 2025,” said RentRedi Co-founder and CEO Ryan Barone. “Using our platform to streamline processes from listings and tenant screening to rent collection and maintenance coordination allows landlords to work efficiently and scale quickly by managing everything in one place on a phone, mobile device, or desktop computer from any location.”

Scaling with RentRedi is easy and cost-effective because RentRedi offers unique flat pricing subscriptions that do not increase as investors scale their portfolios. Landlords can add an unlimited number of properties, units, tenants, and users to their account and take advantage of accelerated 2-day funding and same-day settlements with no increase to their subscription rate. Furthermore, using RentRedi features like autopay, tenant screening, and Credit Boost can result in up to 99% on-time rent payments.

Survey Methodology

RentRedi landlords were surveyed between November 7-22, 2024. There were 3,749 respondents in total. Landlords were classified into U.S. regions by their primary business location as follows: Northeast (CT, MA, ME, NH, NJ, NY, PA, RI); Midwest (IA, IL, IN, KS, MI, MN, MO, ND, NE, OH, SD, WI, VT); South (AL, AR, DC, DE, FL, GA, KY, LA, MD, MS, NC, OK, SC, TN, TX, VA, WV); and West (AK, AZ, CA, CO, HI, ID, MT, NM, NV, OR, UT, WA, WY). Landlords were also classified by real estate portfolio size as follows: small landlords (1-4 rental units); medium landlords (5-19 rental units); and large landlords (20+ rental units). Percentages have been rounded to the nearest whole number, and therefore the values in each barchart may not equal 100%. The full survey results can be found here.

About RentRedi

RentRedi offers an award-winning, comprehensive property management platform that simplifies the renting process for landlords and renters by automating and streamlining processes. Landlords can quickly grow their rental businesses by using RentRedi’s all-in-one web and mobile app to collect rent, list and market vacancies, find and screen tenants, sign leases, and manage maintenance and accounting. Tenants enjoy the convenience and benefits of RentRedi’s easy-to-use mobile app that allows them to pay rent, set up auto-pay, build credit by reporting rent payments to all three major credit bureaus, prequalify and sign leases, and submit 24/7 maintenance requests.

Founded in 2016, RentRedi is VC-backed and a proven leader in the PropTech market. The company ranks No. 180 on the Inc. 5000 list and No. 12 on the Inc. 5000 Regionals list. It was also named an Inc. Power Partner in 2023 and 2024, and to Fast Company’s Next Big Things in Tech list in 2024, and to HousingWire’s Tech100 list in 2025. To date, RentRedi has more than $28 billion in assets under management with nearly 200,000 landlords and tenants using the platform. The company partners with technology leaders such as Zillow, TransUnion, Experian, Equifax, Realtor.com, Lessen, Thumbtack, Plaid, and Stripe to create the best customer experience possible. For more information visit RentRedi.com.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e5842125-938c-4030-a879-99d9d2f7160e

https://www.globenewswire.com/NewsRoom/AttachmentNg/9cac1b71-5fbb-45f0-9383-3e3e78c29f1b